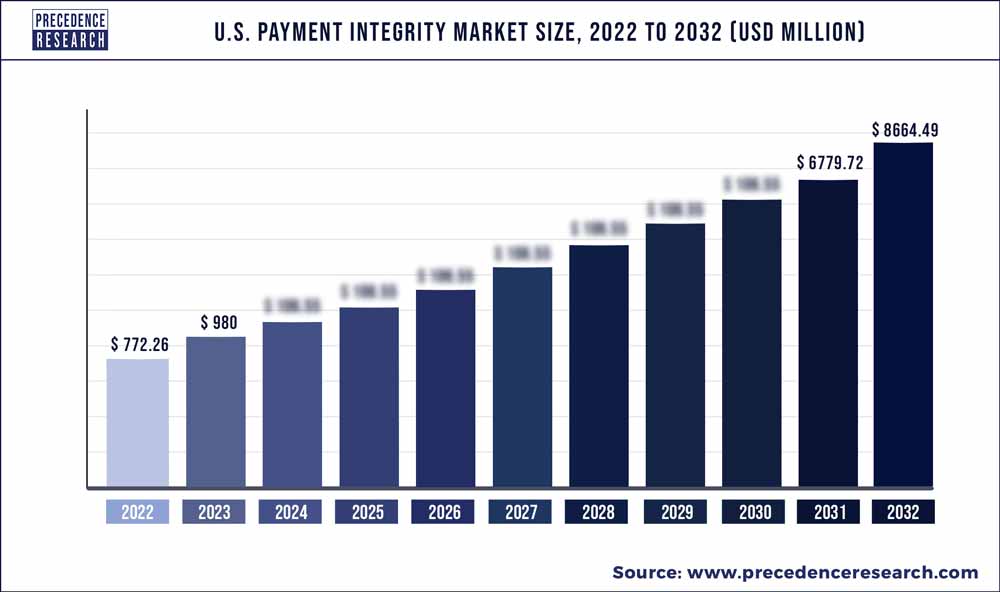

According to the new research report published by Precedence Research, titled “U.S. Payment Integrity Market (By Component: Software, Services; By Function: Query & Reporting, OLAP & Visualization, Performance Management; By Application: Pre-Payment, Post-Payment, FWA, Others; By Mode of Delivery: On-Premises, Cloud-Based, Hybrid; By End Use: Payers, Healthcare Providers) – Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2032 (By Product: Traditional, Advanced; By Application: Pottery, Tiles, Abrasives, Sanitary wave, Bricks & pipes, Others; By End User: Medical, Industrial, Building & Construction, Others) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032”, the global U.S. payment integrity market size is expected to be worth around US$ 8,664.49 million by 2032 and is poised to record a yearly growth rate of 27.4% from 2023 to 2032. The study investigates several elements and their consequences on the growth of the all-wheel drive market.

This report focuses on U.S. payment integrity market volume and value at the global level, regional level and company level. From a global perspective, this report represents the overall U.S. payment integrity market size by analysing historical data and future prospects. Regionally, this report focuses on several key regions: North America, Europe, the Middle East & Africa, Latin America, etc.

The research report includes specific segments by region (country), by company, by all segments. This study provides information about the growth and revenue during the historic and forecasted period of 2017 to 2032. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

Download a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/3060

The study also provides important advancements in organic and inorganic growth strategies in the worldwide U.S. payment integrity market. A lot of corporations are prioritizing new launches, product approvals, and other business expansion techniques. In addition, the report offers profiles of U.S. payment integrity market firms and market strategies. Furthermore, the research focuses on top industry participants, providing information such as company profiles, components and services offered, recent financial data, and key developments.

U.S. Payment Integrity Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 980 Million |

| Market Size by 2032 | USD 8,664.49 Million |

| Growth Rate from 2023 to 2032 | CAGR of 27.4% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Component, By Function, By Application, By Mode of Delivery, and By End Use |

Also read: Biologics Contract Development Market Size US$ 18.71 Billion by 2032

Market Key Players

Company profiles have been included in the report, which include essentials such as product portfolio, key strategies, along with all-inclusive SWOT analysis on each player. Company presence is mapped and presented through a matrix for all the prominent players, thus providing readers with actionable insights, which helps in thoughtfully presenting market status and predicting the competition level in the U.S. payment integrity market.

Some of the prominent players in the U.S. payment integrity market include

- Cotiviti

- Optum / Change Healthcare

- Zelis

- Availity

- MultiPlan

- Ceris

- Cognizant

- EXL

- Performant

- Syrtis

- Varis

- ClarisHealth

- ClaimLogiq

- Rialtic

- HealthEdge

U.S. Payment Integrity Market Segmentations

By Component

- Software

- Services

By Function

- Query & Reporting

- OLAP & Visualization

- Performance Management

By Application

- Pre-Payment

- Claims Editing (1st pass)

- Claims Editing (2nd, 3rd, etc.)

- Coding Validation

- Post-Payment

- Complex/Clinical Provider Audit

- Coordination of Benefits (COB)

- Subrogation

- Data Mining

- FWA

- Provider Fraud, Waste & Abuse

- Special Investigations

- Others

- Reporting and Analytics

- Others

By Mode of Delivery

- On-Premises

- Cloud-Based

- Hybrid

By End Use

- Payers

- Healthcare Providers

Report Objectives

- To define, segment, and project the global market size for U.S. payment integrity market

- To understand the structure of the market by identifying its various sub-segments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyse the micro-markets, with respect to individual growth trends, future prospects, and their contributions to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to global. (along with their respective key countries)

- To profile key players and comprehensively analyse their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across the globe.

- To analyse the competitive developments such as expansions & investments, new product launches, mergers & acquisitions, joint ventures, and agreements

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Payment Integrity Market

5.1. COVID-19 Landscape: U.S. Payment Integrity Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Payment Integrity Market, By Component

8.1. U.S. Payment Integrity Market, by Component, 2023-2032

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Payment Integrity Market, By Function

9.1. U.S. Payment Integrity Market, by Function, 2023-2032

9.1.1. Query & Reporting

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. OLAP & Visualization

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Performance Management

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Payment Integrity Market, By Application

10.1. U.S. Payment Integrity Market, by Application, 2023-2032

10.1.1. Pre-Payment

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Post-Payment

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. FWA

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Payment Integrity Market, By Mode of Delivery

11.1. U.S. Payment Integrity Market, by Mode of Delivery, 2023-2032

11.1.1. On-Premises

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Cloud-Based

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Hybrid

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Payment Integrity Market, By End Use

12.1. U.S. Payment Integrity Market, by End Use, 2023-2032

12.1.1. Payers

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Healthcare Providers

12.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 13. U.S. Payment Integrity Market, Countries Estimate and Trends Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.2. Market Revenue and Forecast, by Function (2020-2032)

13.1.3. Market Revenue and Forecast, by Application (2020-2032)

13.1.4. Market Revenue and Forecast, by Mode of Delivery (2020-2032)

13.1.5. Market Revenue and Forecast, by End Use (2020-2032)

Chapter 14. Company Profiles

14.1. Cotiviti

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Optum / Change Healthcare

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Zelis

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Availity

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. MultiPlan

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Ceris

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Cognizant

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. EXL

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Performant

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Syrtis

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Why should you invest in this report?

If you are aiming to enter the global U.S. payment integrity market, this report is a comprehensive guide that provides crystal clear insights into this niche market. All the major application areas for U.S. payment integrity are covered in this report and information is given on the important regions of the world where this market is likely to boom during the forecast period of 2023-2030 so that you can plan your strategies to enter this market accordingly.

Besides, through this report, you can have a complete grasp of the level of competition you will be facing in this hugely competitive market and if you are an established player in this market already, this report will help you gauge the strategies that your competitors have adopted to stay as market leaders in this market. For new entrants to this market, the voluminous data provided in this report is invaluable.

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com