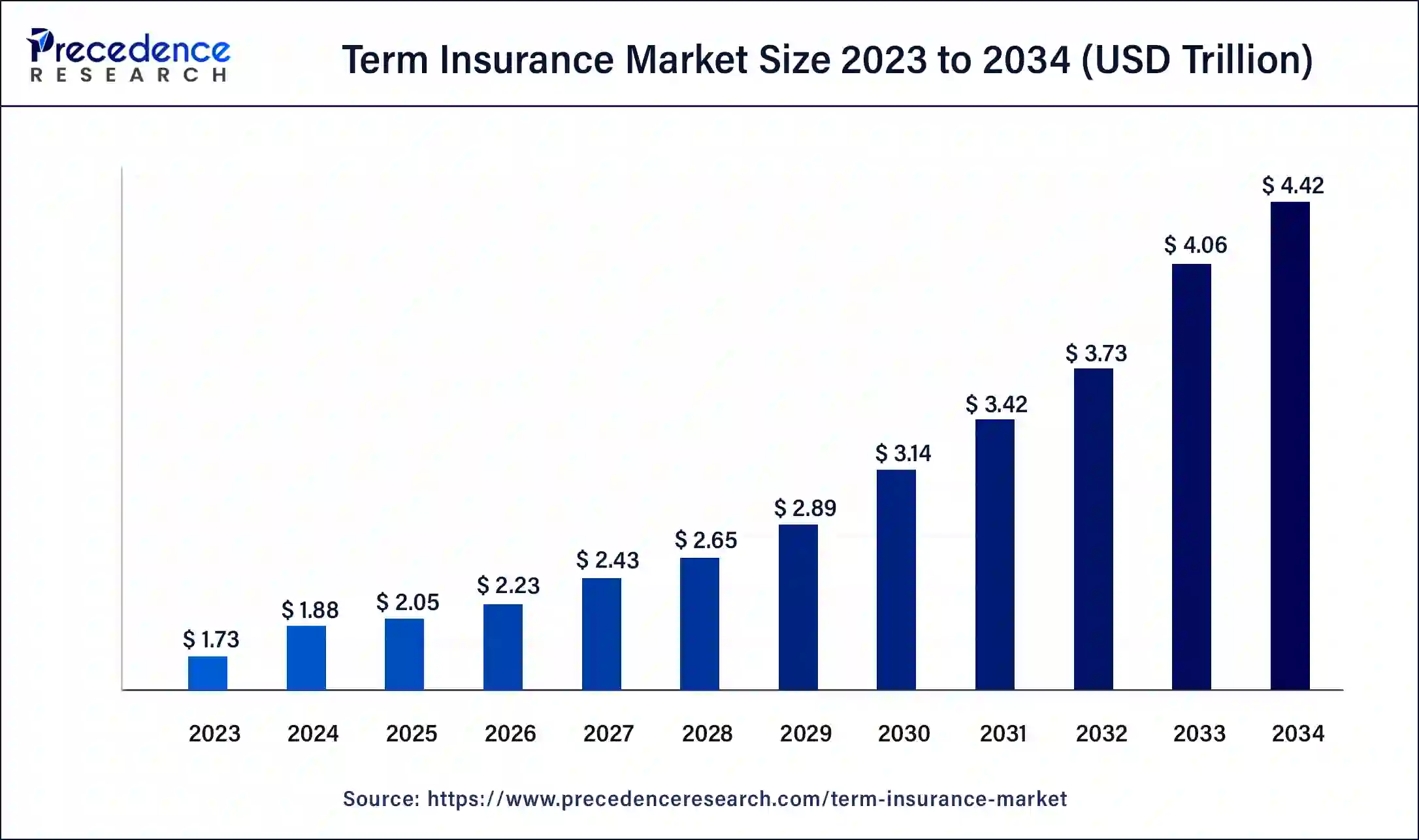

The global term insurance market size is anticipated to hit around USD 4 trillion by 2033, growing at a CAGR of 8.75% from 2024 to 2033.

Key Points

- Asia-Pacific has contributed more than 34% of market share in 2023.

- Europe is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, in 2023, the individual-level term life insurance segment has held the highest market share of 76%.

- By type, the group-level term insurance segment is anticipated to witness rapid growth at a significant CAGR during the projected period.

- By distribution channel, the tied agents & branches segment has held 53% market share in 2023.

- By distribution channel, the light brokers segment is anticipated to witness rapid growth over the projected period.

The term insurance market plays a crucial role in the insurance industry, providing financial protection to policyholders for a specified period, typically ranging from 5 to 30 years. Term insurance offers a pure risk cover, wherein policyholders pay premiums in exchange for a death benefit payout to beneficiaries in the event of the policyholder’s demise during the term of the policy. This segment of the insurance market has witnessed significant growth in recent years due to various factors such as increasing awareness about financial planning, rising disposable incomes, and evolving customer preferences.

Get a Sample: https://www.precedenceresearch.com/sample/3989

Growth Factors

Several key growth factors contribute to the expansion of the term insurance market globally. One primary factor is the growing awareness of the importance of financial protection and risk management among individuals and families. As people become more cognizant of the uncertainties of life and the need to secure their loved ones’ financial future, they increasingly seek out term insurance products to provide a safety net. Additionally, favorable regulatory frameworks and product innovation by insurance companies have made term insurance more accessible and affordable to a broader segment of the population, further driving market growth.

Region Insights:

The term insurance market exhibits varying dynamics across different regions of the world. In mature markets such as North America and Europe, the market is characterized by high penetration rates and a wide range of product offerings tailored to diverse customer needs. In contrast, emerging markets in Asia-Pacific, Latin America, and Africa present immense growth opportunities fueled by rising incomes, expanding middle-class populations, and increasing insurance awareness. Countries like India and China are witnessing robust growth in term insurance penetration, driven by demographic shifts and regulatory initiatives aimed at promoting insurance penetration.

Term Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.75% |

| Global Market Size in 2023 | USD 1.73 Trillion |

| Global Market Size by 2033 | USD 4 Trillion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Term Insurance Market Dynamics

Drivers:

Several drivers propel the growth of the term insurance market globally. One significant driver is demographic trends, including population growth, urbanization, and an aging population. As the global population expands and ages, the demand for financial protection products such as term insurance increases, driving market growth. Moreover, changing lifestyles, increasing financial responsibilities, and a growing emphasis on individual financial planning further fuel the demand for term insurance products. Additionally, advancements in technology and distribution channels enable insurance companies to reach untapped markets and offer personalized solutions to customers, driving market expansion.

Opportunities:

The term insurance market presents numerous opportunities for insurers to capitalize on emerging trends and market dynamics. The growing adoption of digital technologies such as mobile apps, online platforms, and data analytics enables insurers to enhance customer engagement, streamline processes, and offer innovative products and services. Moreover, partnerships with banks, financial institutions, and digital platforms expand insurers’ distribution reach and access to potential customers. Additionally, rising demand for customizable and flexible insurance solutions presents opportunities for insurers to tailor their products to meet diverse customer needs and preferences.

Challenges:

Despite its growth prospects, the term insurance market faces several challenges that can hinder its expansion. One significant challenge is the perception of term insurance as a low-engagement product compared to other life insurance products such as whole life or unit-linked insurance plans. Overcoming customer inertia and increasing awareness about the benefits of term insurance require targeted marketing efforts and education initiatives by insurers. Moreover, regulatory constraints, pricing pressures, and competition from alternative financial products pose challenges to insurers in terms of profitability and market share. Additionally, the lack of trust in insurance companies and concerns about claim settlement processes may deter potential customers from purchasing term insurance policies.

Read Also: Compartment Syndrome Monitoring Devices Market Size, Report 2033

Recent Developments

- In December 2023, The Smart Total Elite Protection Plan, a comprehensive term life insurance policy created to fit modern lifestyles, was unveiled by Max Life Insurance Company. This plan provides broad coverage that is tailored to changing customer needs.

- In June 2023, after receiving an IRDAI license in just two weeks, Go Digit Life Insurance Limited, a life insurance company supported by modern technology, started operations. In order to “Make insurance simple,” the “Digit Life Group Term Insurance” plan will prioritize providing high customizability to its clients, or groups.

- In May 2023, The American mutual life insurer New York Life debuted a broad selection of affordably cost term life insurance products. These services increase the return on clients’ investments in protection while preparing them for opportunities and financial uncertainty.

Term Insurance Market Companies

- MetLife (United States)

- AIA Group Limited (Hong Kong)

- Prudential Financial Inc. (United States)

- Manulife Financial Corporation (Canada)

- China Life Insurance Company Limited (China)

- Allianz SE (Germany)

- New York Life Insurance Company (United States)

- Japan Post Holdings Co., Ltd. (Japan)

- Ping An Insurance (Group) Company of China, Ltd. (China)

- Northwestern Mutual Life Insurance Company (United States)

- State Farm Mutual Automobile Insurance Company (United States)

- AXA S.A. (France)

- Dai-ichi Life Holdings, Inc. (Japan)

- Zurich Insurance Group Ltd. (Switzerland)

- LIC (Life Insurance Corporation of India) (India)

Segments Covered in the Report

By Type

- Individual Level Term Life Insurance

- Group Level Term Life Insurance

- Decreasing Term Life Insurance

By Distribution Channel

- Tied Agents & Branches

- Brokers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/