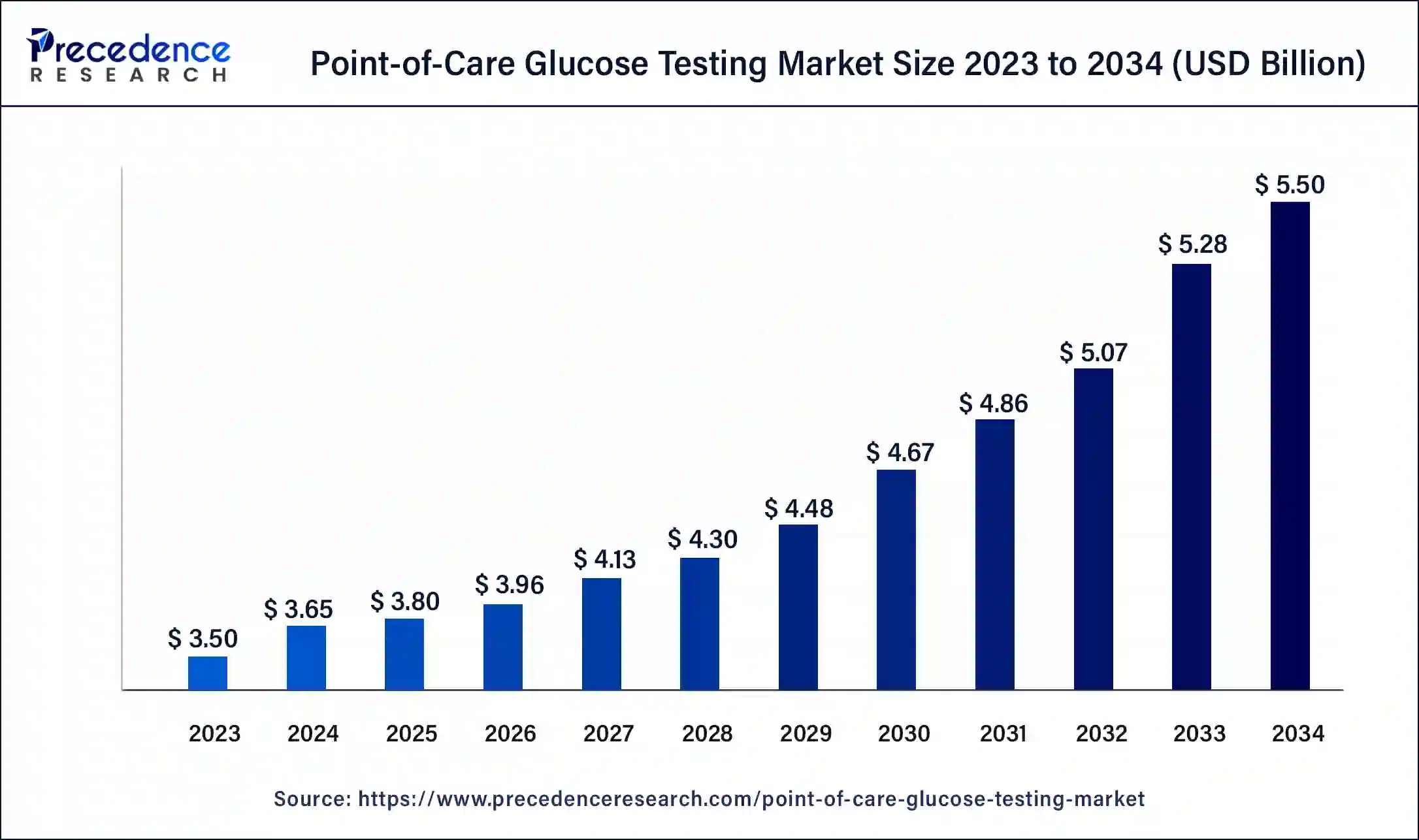

The global point-of-care glucose testing market size is expected to grow around USD 5.20 billion by 2033, growing at a CAGR of 4.03% from 2024 to 2033.

Key Points

- The North America point-of-care glucose testing market size surpassed USD 1.44 billion in 2023 and is expected to be worth around USD 2.13 billion by 2033.

- North America dominated the global point-of-care glucose testing market in 2023 with a revenue share of 41%.

- Asia Pacific is witnessing significant growth in the point-of-care glucose testing market.

- By product, in 2023, the lancing devices and strips segment held the largest share of 63%.

- By application, the type 2 diabetes segment dominated the market in 2023 with a revenue share of 81%.

- By end use, the home care setting segment has accounted revenue share of 62% in 2023.

with immediate results, enabling timely decision-making and management of conditions such as diabetes. Point-of-care glucose testing is critical for managing diabetes and preventing complications through real-time monitoring and adjustments to treatment plans.

The market for point-of-care glucose testing has experienced significant growth due to the increasing prevalence of diabetes globally, the aging population, and the rising awareness of preventive healthcare. Additionally, advancements in technology have led to the development of more efficient, accurate, and easy-to-use testing devices, further propelling the market’s expansion.

Get a Sample: https://www.precedenceresearch.com/sample/4087

Growth Factors:

- Increasing Prevalence of Diabetes: The rising incidence of diabetes worldwide is one of the primary growth factors driving the point-of-care glucose testing market. The growing aging population, sedentary lifestyles, and unhealthy eating habits contribute to the prevalence of diabetes, leading to a greater need for regular glucose monitoring.

- Technological Advancements: Innovations in point-of-care glucose testing devices have led to more accurate, user-friendly, and affordable products. Features such as wireless connectivity and integration with smartphone apps enhance user experience and provide valuable data for healthcare professionals.

- Government Initiatives and Healthcare Policies: Many governments and healthcare organizations are promoting early diagnosis and management of diabetes through policies and programs. These initiatives often include subsidies for glucose testing devices and awareness campaigns, boosting market growth.

- Homecare and Remote Monitoring: The trend toward homecare and remote monitoring has led to an increased demand for point-of-care glucose testing devices. Patients and caregivers prefer convenient, quick, and accurate methods for monitoring glucose levels at home.

Region Insights:

- North America: North America is a dominant region in the point-of-care glucose testing market, driven by a high prevalence of diabetes, advanced healthcare infrastructure, and favorable reimbursement policies. The region’s focus on research and development also contributes to the growth of the market.

- Europe: Europe is another significant market for point-of-care glucose testing, with countries such as Germany, France, and the UK leading the way. The region benefits from high healthcare expenditure, strong regulatory support, and an increasing emphasis on preventive healthcare.

- Asia-Pacific: The Asia-Pacific region is expected to witness substantial growth in the point-of-care glucose testing market due to its large and rapidly aging population, increasing prevalence of diabetes, and improving healthcare infrastructure. Countries such as China and India are major contributors to market growth.

- Latin America and Middle East & Africa: These regions present growth opportunities for the point-of-care glucose testing market due to increasing awareness of diabetes management and improving healthcare infrastructure. However, challenges such as limited access to healthcare and economic constraints may impact market growth.

Point-of-Care Glucose Testing Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.03% |

| Global Market Size in 2023 | USD 3.50 Billion |

| Global Market Size in 2024 | USD 3.64 Billion |

| Global Market Size by 2033 | USD 5.20 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Point-of-Care Glucose Testing Market Dynamics

Drivers:

- Rising Awareness of Diabetes Management: Increased awareness about the importance of regular glucose monitoring for diabetes management is driving the demand for point-of-care glucose testing devices.

- Convenience and Speed of Testing: Point-of-care glucose testing offers rapid results, enabling immediate decision-making and treatment adjustments. This convenience is a major driver for the market.

- Cost-Effectiveness: Compared to laboratory testing, point-of-care glucose testing is often more cost-effective, making it an attractive option for both patients and healthcare providers.

- Increasing Healthcare Expenditure: Rising healthcare expenditure in many regions allows for greater investment in innovative medical devices, including point-of-care glucose testing systems.

Challenges:

- Regulatory Hurdles: The medical device industry faces stringent regulatory requirements that can slow down the introduction of new products into the market.

- Accuracy and Reliability Concerns: Ensuring the accuracy and reliability of point-of-care glucose testing devices remains a challenge. Variability in results can impact patient care.

- Cost Constraints: Despite being cost-effective compared to laboratory testing, the initial cost of point-of-care glucose testing devices can be prohibitive for some patients, particularly in developing regions.

- Limited Access to Healthcare: In certain regions, limited access to healthcare services and testing devices can hinder market growth and adoption.

Opportunities:

- Technological Advancements: Continued advancements in point-of-care glucose testing technology, such as non-invasive methods, miniaturization, and AI integration, present significant opportunities for market growth.

- Expansion in Emerging Markets: Emerging markets offer opportunities for expansion due to increasing healthcare expenditure, growing awareness of diabetes management, and improving healthcare infrastructure.

- Collaborations and Partnerships: Collaborations between device manufacturers, healthcare providers, and technology companies can lead to the development of innovative products and services that enhance the point-of-care glucose testing market.

- Focus on Homecare and Remote Monitoring: The shift toward homecare and remote monitoring provides opportunities for companies to develop user-friendly devices that cater to the needs of patients managing diabetes at home.

Read Also: CNC Milling Machines Market Size to Grow USD 113 Bn by 2033

Recent Developments

- In February 2024, Trinity Biotech (TRIB) finalized a conclusive agreement to purchase the biosensor and Continuous Glucose Monitoring (CGM) assets from Waveform Technologies. This strategic acquisition, valued at $12.5 million in cash and 9 million American Depositary Shares (ADSs) of the company, alongside additional considerations, positions Trinity Biotech to innovate diabetes care and upgrade its presence in the biosensor market.

- In July 2023, Avricore Health and Ascensia Diabetes Care revealed a partnership to incorporate blood glucose monitoring into point-of-care testing. The collaboration seeks to integrate the Contour Next-Gen and Contour Next One BGM systems into Avricore’s HealthTab PCOT platform.

- In June 2023, the initial locally produced continuous glucose monitoring device was approved by the South Korean Ministry of Food and Drug Safety. I-SENS, the manufacturer of blood glucose devices, introduced CareSens Air, which claimed to be the most compact and lightweight CGM device accessible in South Korea. It can be utilized continuously for 15 days and incorporates a calibration mechanism to enhance the accuracy of readings.

- In January 2022, Roche introduced the Cobas Pulse, a point-of-care blood glucose monitor meant for hospital personnel, along with a companion gadget structured like a touchscreen smartphone that will run its apps. The Cobas pulse will begin shipping to certain European countries with a CE mark.

Point-of-Care Glucose Testing Market Companies

- Abbott (U.S.)

- Dexcom (U.S.)

- Roche (Switzerland)

- Ascensia Diabetes Care (Switzerland)

- LifeScan (U.S.)

- Medtronic (U.S.)

- Ypsomed (Switzerland)

- Animas (U.S.)

- Insulet (U.S.)

- Bayer (Germany)

- Nipro (Japan)

- Terumo (Japan)

- Arkray (Japan)

- Acon Laboratories (U.S.)

- Freestyle (U.S.)

- One Touch (U.S.)

- Accu-Chek (Germany)

- Dario (U.S.)

- iHealth (China)

- FreeStyle Libre (UK)

Segments Covered in the Report

By Product

- Lancing Devices and Strips

- Blood-Glucose Meter

- Type

- Lifescan OneTouch Ultra and Lifescan OneTouch Verio

- Accu-Chek Aviva Plus and Accuchek

- Freestyle Lite and Freestyle Precission Neo

- Contour Next

- Others

- Type

By Application

- Type-1 Diabetes

- Type-2 Diabetes

By End User

- Hospitals and Clinics

- Home Care Settings

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/