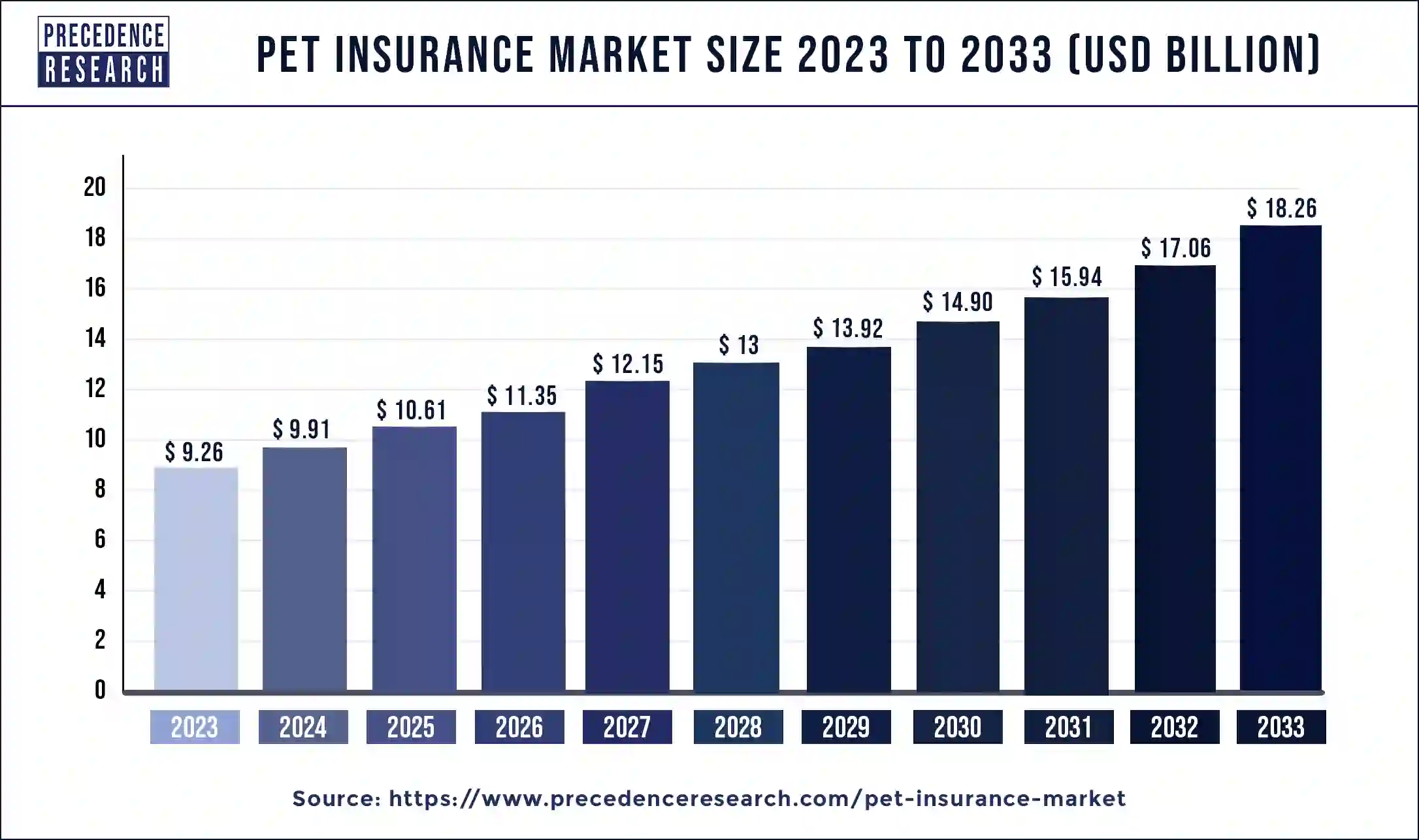

The global pet insurance market size is estimated to hit around USD 18.26 billion by 2033, growing at a CAGR of 7.03% from 2024 to 2033.

Key Points

- Europe dominated the global market with the largest market share of 35% in 2023.

- North America is expected to witness notable growth during the forecast period.

- By policy type, the accident & illness segment has contributed 97% of market share in 2023.

- By end-user, the dogs segment dominated the market in 2023.

- By end-user, the cats segment is expected to gain a significant share during the upcoming years.

The pet insurance market has experienced significant growth in recent years, driven by increasing pet ownership, rising healthcare costs for pets, and growing awareness of the importance of pet health and wellness. Pet insurance provides financial protection to pet owners by covering veterinary expenses, including routine check-ups, vaccinations, surgeries, and emergency treatments. This overview will delve into the key factors influencing the growth of the pet insurance market, regional insights, drivers, opportunities, and challenges facing the industry.

Growth Factors

Several factors contribute to the growth of the pet insurance market. The rising number of pet owners globally, fueled by changing lifestyles and increased disposable income, has led to greater demand for pet healthcare services, including insurance coverage. Moreover, advancements in veterinary medicine and technology have expanded treatment options for pets, driving up healthcare costs and increasing the need for insurance coverage. Additionally, the humanization of pets, where pets are increasingly considered part of the family, has elevated the importance of their health and well-being, further driving demand for pet insurance.

Get a Sample: https://www.precedenceresearch.com/sample/3982

Region Insights:

The pet insurance market exhibits varying degrees of penetration and growth across different regions. In North America and Europe, where pet ownership rates are high and pet healthcare standards are well-established, the market for pet insurance is mature and continues to grow steadily. In contrast, regions such as Asia-Pacific and Latin America are experiencing rapid growth in pet insurance adoption, driven by rising pet ownership rates, increasing urbanization, and a growing middle class with greater purchasing power.

Pet Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Global Market Size in 2023 | USD 9.26 Billion |

| Global Market Size by 2033 | USD 18.26 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Policy Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Insurance Market Dynamics

Drivers:

Several drivers propel the growth of the pet insurance market. One key driver is the increasing awareness among pet owners about the benefits of insurance in managing the cost of veterinary care. Pet insurance offers financial peace of mind, enabling pet owners to provide the best possible care for their furry companions without worrying about the financial burden of unexpected medical expenses. Additionally, partnerships between pet insurance providers and veterinary clinics, pet retailers, and online platforms have expanded distribution channels and increased accessibility to pet insurance products, driving market growth.

Opportunities

The pet insurance market presents numerous opportunities for expansion and innovation. As pet ownership continues to rise globally, there is untapped potential to penetrate new markets and increase insurance coverage among pet owners. Moreover, the growing trend towards preventive care and wellness services for pets creates opportunities for insurers to offer comprehensive coverage plans that include routine check-ups, vaccinations, and wellness exams. Furthermore, advancements in data analytics and technology present opportunities to enhance the customer experience, streamline claims processing, and develop personalized insurance solutions tailored to the specific needs of pet owners and their pets.

Challenges

Despite its growth potential, the pet insurance market faces several challenges. One significant challenge is the lack of awareness and understanding of pet insurance among pet owners, particularly in emerging markets where insurance penetration rates are low. Educating consumers about the benefits of pet insurance and dispelling misconceptions about its coverage and cost are essential for driving market growth. Additionally, regulatory hurdles, including licensing requirements and consumer protection regulations, vary across regions and can pose challenges for insurers entering new markets. Moreover, rising healthcare costs for pets and the increasing prevalence of complex and costly medical procedures present challenges in managing claims costs and pricing premiums competitively.

Read Also: Joint Reconstruction Devices Market Size, Trends Report by 2033

Recent Developments

- In 2024, a leading cloud-based company called Five Sigma collaborated with Odie Pet Insurance to make pet insurance accessible and affordable in many regions. These companies aim to accelerate the pet insurance market.

- In 2023, a pet insurance platform named Independent Pet Group (IPG) partnered with Felix for the insurance of cats in the United States.

- In 2023, The global risk partners acquired Petsmedicover, a pet insurance broker in the United Kingdom.

- In 2023, a company called ‘Go Digit General Insurance’ collaborated with Vetina to offer insurance coverage, especially for dogs.

- In 2023, Best Friends Animal Society (BFAS), an animal welfare organization, partnered with Fetch to promote the shelter of dogs and cats in America. This collaboration will aim to provide a shelter for pets.

Pet Insurance Market Companies

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

- Pumpkin Insurance Services Inc.

Segments Covered by the Report

By Policy Type

- Accident

- Accident & Illness

- Embedded Wellness

By End-user

- Dogs

- Cats

- Horses

- Exotic Pets

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/