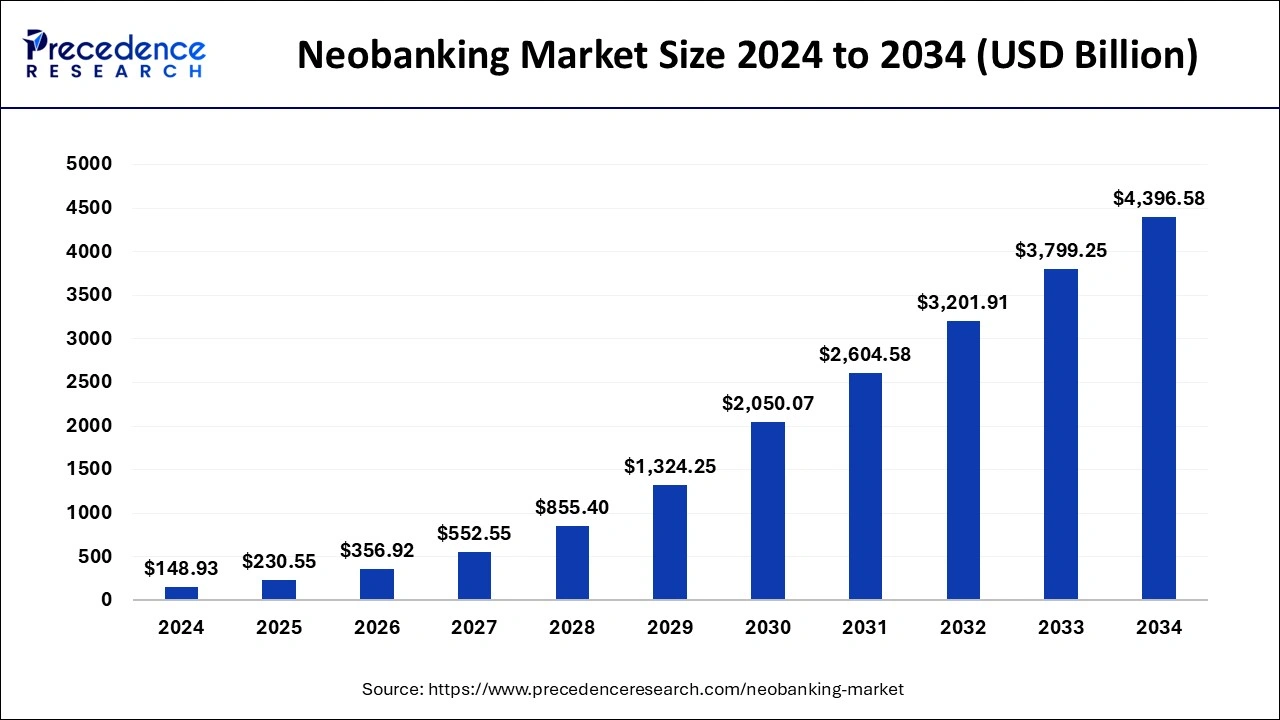

The global neobanking market size is estimated to rake around USD 3,799.25 billion by 2033, growing at a CAGR of 44.42% from 2024 to 2033.

Key Points

- Europe dominated the market with the largest revenue share of 34% in 2023.

- Asia Pacific is expected to experience significant expansion in the market in the upcoming years.

- By account type, the business account segment has held the major revenue share of 67% in 2023.

- By account type, the saving accounts segment is expected to witness significant growth in the market over the projected period.

- By application, the enterprise segment has recorded more than 52% of revenue share in 2023.

- By application, the personal segment is expected to witness the fastest growth in the market.

The neobanking market is witnessing significant growth globally, driven by the increasing adoption of digital banking solutions and the rise of fintech startups. Neobanks, also known as digital banks or challenger banks, are financial institutions that operate exclusively online without physical branches. They offer a range of banking services, including savings accounts, checking accounts, loans, and payment solutions, all accessible through mobile applications and web platforms. The market is characterized by its focus on customer-centric services, innovative technology-driven solutions, and agile operations, challenging traditional banking models.

Get a Sample: https://www.precedenceresearch.com/sample/4315

Growth Factors

Several factors contribute to the growth of the neobanking market. Firstly, the growing preference for digital banking among consumers, especially millennials and Gen Z, who prioritize convenience, accessibility, and personalized experiences. Secondly, the increasing smartphone penetration and internet connectivity worldwide have expanded the potential customer base for neobanks. Additionally, regulatory initiatives promoting open banking and fintech innovation have created favorable environments for neobanks to enter and compete in the financial services sector.

Region Insights

The neobanking trend is observed across various regions, with different degrees of adoption and regulatory landscapes. In regions like Europe and North America, neobanks have gained substantial traction, fueled by supportive regulatory frameworks, tech-savvy populations, and a competitive banking landscape. In emerging markets such as Asia-Pacific, Latin America, and Africa, neobanks are rapidly emerging to cater to underserved populations, offering affordable and accessible banking services through digital channels.

Neobanking Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 44.42% |

| Neobanking Market Size in 2023 | USD 96.20 Billion |

| Neobanking Market Size in 2024 | USD 148.93 Billion |

| Neobanking Market Size by 2033 | USD 3,799.25 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Account Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Neobanking Market Dynamics

Drivers

Key drivers propelling the growth of the neobanking market include the demand for seamless digital banking experiences, cost-effective operations enabled by cloud-based infrastructure, and partnerships with fintech companies to offer innovative financial products and services. Moreover, the ability of neobanks to leverage data analytics and artificial intelligence for personalized financial recommendations and risk assessment enhances customer engagement and loyalty.

Opportunities

The neobanking market presents various opportunities for expansion and differentiation. Neobanks can capitalize on niche markets or underserved segments by offering specialized financial products tailored to specific demographics or industries. Furthermore, partnerships with traditional banks, fintech startups, and other ecosystem players can facilitate access to new markets, technology integrations, and regulatory compliance, fostering growth and scalability.

Challenges

Despite the promising growth prospects, neobanks face several challenges in scaling their operations and achieving profitability. Building trust and brand recognition in a crowded market, ensuring compliance with regulatory requirements, and addressing cybersecurity risks are primary concerns. Additionally, achieving sustainable revenue streams, managing customer acquisition costs, and maintaining competitive interest rates amid fluctuating market conditions pose challenges to profitability and long-term viability.

Read Also: Dental Suction Systems Market Size to Rake USD 1,047.02 Mn by 2033

Neobanking Market Recent Developments

- In May 2024, Monzo, a British neobank, announced on Wednesday that it has raised a further $190 million, bringing its total fundraising this year to $610 million. The business informed CNBC that it had secured funding from new investors, among them Hedosophia, a supporter of prominent European fintechs such as N26 and Qonto. Alphabet’s separate growth fund, CapitalG, took part in the deal as well.

- In February 2024, Swedish customers can now access the services of Saldo Bank, a Finnish neobank that is overseen by the Bank of Lithuania and has its headquarters in Lithuania. Saldo Bank’s strategy centers on providing competitive interest rates, with the goal of drawing clients in with its alluring offers.

Neobanking Market Companies

- Monzo

- N26

- Revoult

- Atom bank

- Starling bank

- Chime

- Simple

- Moven

- Webank

Segment Covered in the Report

By Account Type

- Business Account

- Saving Account

By Application

- Enterprises

- Personal

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/