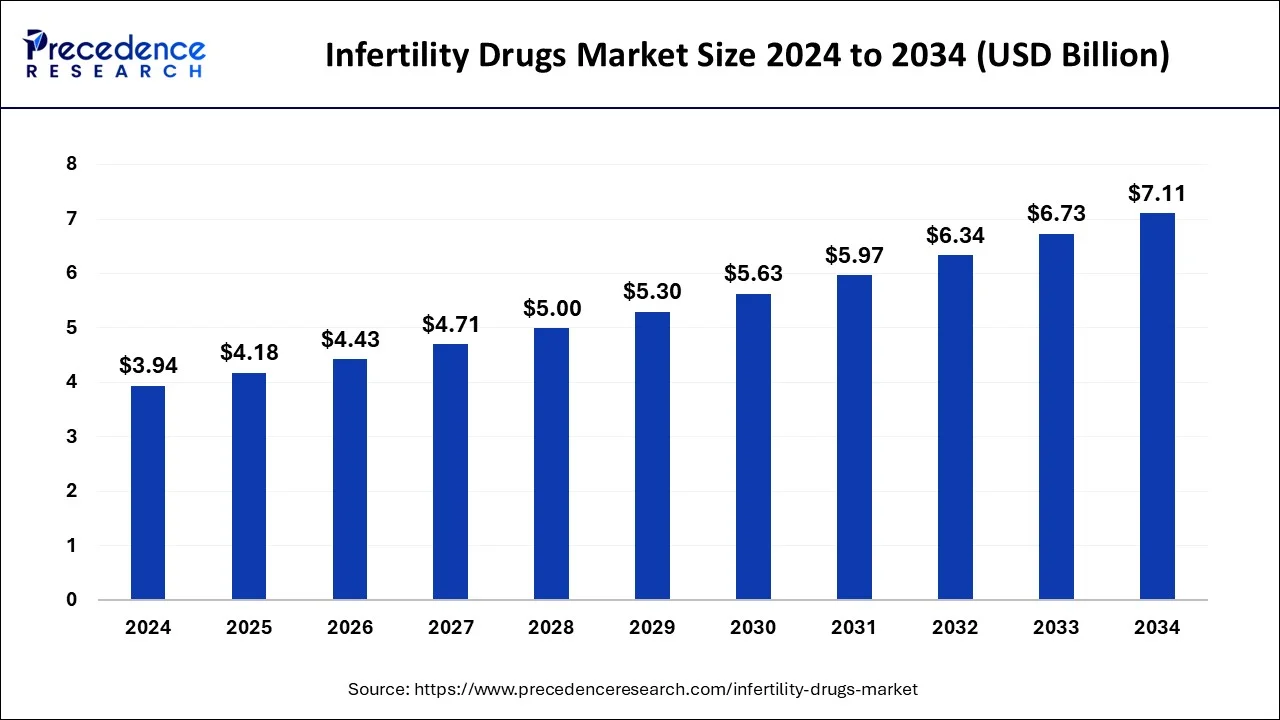

The global infertility drugs market size is estimated to rake around USD 6.73 billion by 2033, growing at a CAGR of 6.13% from 2024 to 2033.

Key Points

- The global infertility drugs market size accounted for USD 1.45 billion in 2023 and is expected to rise around USD 2.65 billion by 2033.

- North America dominated the market with the largest market share of 39% in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 6.93% during the forecast period.

- By drug class, the gonadotropins segment has contributed more than 41% of market share in 2023.

- By the drug class, the selective estrogen receptor modulators segment is predicted to show rapid growth in the market.

- By the distribution channel, the hospital pharmacy segment has generated more than 55% of market share in 2023.

- By distribution channel, the online pharmacy segment is expected to grow at a high rate over the forecast period.

- By end-user, the women segment has contributed more than 74% of market share in 2023.

- By end-user, the men segment will be the fastest-growing segment during the forecast period.

The global infertility drugs market is a rapidly evolving segment within the pharmaceutical industry, driven by increasing rates of infertility worldwide. Infertility drugs are designed to address various causes of infertility, including hormonal imbalances, ovulation disorders, and reproductive health issues. This market is characterized by a diverse range of medications and treatment options, with a focus on improving reproductive outcomes for both men and women. Key players in the market include pharmaceutical companies and fertility clinics, collaborating to develop innovative therapies and expand market reach.

Get a Sample: https://www.precedenceresearch.com/sample/4243

Growth Factors

The growth of the infertility drugs market is propelled by several factors. Firstly, rising infertility rates due to lifestyle changes, delayed pregnancies, and environmental factors are driving demand for fertility treatments. Additionally, advancements in assisted reproductive technologies (ART) such as in vitro fertilization (IVF) have increased the effectiveness of infertility treatments, boosting market growth. Moreover, growing awareness about fertility options and increasing healthcare expenditure are contributing to the expansion of this market globally.

Region Insights

Regionally, the infertility drugs market exhibits varying dynamics. Developed regions like North America and Europe have a robust market due to higher infertility rates and greater accessibility to advanced fertility treatments. In contrast, emerging economies in Asia-Pacific and Latin America are witnessing rapid market growth fueled by improving healthcare infrastructure, rising disposable incomes, and changing societal attitudes towards fertility treatments. Africa, although still nascent, presents untapped potential with increasing investments in healthcare.

Infertility Drugs Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 6.13% |

| Global Market Size in 2023 | USD 3.71 Billion |

| Global Market Size in 2024 | USD 3.94 Billion |

| Global Market Size by 2033 | USD 6.73 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drug Class, By Distribution Channel, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Infertility Drugs Market Dynamics

Drivers

Key drivers of the infertility drugs market include the increasing prevalence of conditions such as polycystic ovary syndrome (PCOS) and endometriosis, which contribute to infertility in women. In men, factors such as low sperm count and sperm motility issues drive demand for male infertility treatments. Additionally, supportive government initiatives aimed at improving access to fertility treatments and reducing treatment costs are fostering market expansion. The trend towards delayed pregnancies due to career pursuits and lifestyle choices is also boosting market demand for infertility drugs.

Opportunities

The infertility drugs market offers several opportunities for industry players. Strategic partnerships between pharmaceutical companies and fertility clinics can enhance research and development efforts, leading to the introduction of novel treatments. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, presents untapped growth opportunities due to increasing healthcare spending and growing awareness about fertility treatments. Moreover, investments in telemedicine and digital health platforms can improve access to infertility consultations and treatment options globally.

Challenges

Despite growth prospects, the infertility drugs market faces challenges such as regulatory complexities related to reproductive medicine and ethical considerations surrounding assisted reproductive technologies. High treatment costs and limited insurance coverage for infertility treatments pose barriers to market accessibility for some patient populations. Moreover, societal stigmas associated with infertility and cultural perceptions of family planning can impact market acceptance and adoption of fertility treatments.

Read Also: Calcium Peroxide Market Size to Rake USD 3.38 Bn By 2033

Infertility Drugs Market Recent Developments

- In February 2024, Lupin, a major global pharma company, launched Ganirelix Acetate Injection. It is a single-dose prefilled syringe indicated for inhibiting premature luteinizing hormone (LH) surges in women who undergo ovarian hyperstimulation.

- In March 2024, Future Generali India Insurance launched ‘Health PowHER’, a product designed exclusively for women healthcare at various stages of their lives. There will be varios treatments offered by the product, and one of the treatments will be infertility treatment. This will include oocyte cryopreservation, stem cell storage, wellness programme, insurance for newborn defects, nursing care, and many more benefits.

Infertility Drugs Market Companies

- Merck & Co., Inc.

- Ferring B.V.

- Organon Group of Companies

- Abbott

- Novartis AG

- Bayer AG

- Pfizer Inc.

- Mankind Pharma

- Teva Pharmaceutical Industries LTD.

- Sanofi

Segments Covered in the Report

By Drug Class

- Gonadotropins

- Aromatase Inhibitors

- Selective Estrogen Receptor Modulators (SERMs)

- Dopamine Agonists

- Others

By Distribution Channel

- Hospital Pharmacy

- Specialty & Retail Pharmacy

- Online Pharmacy

By End-user

- Men

- Women

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/