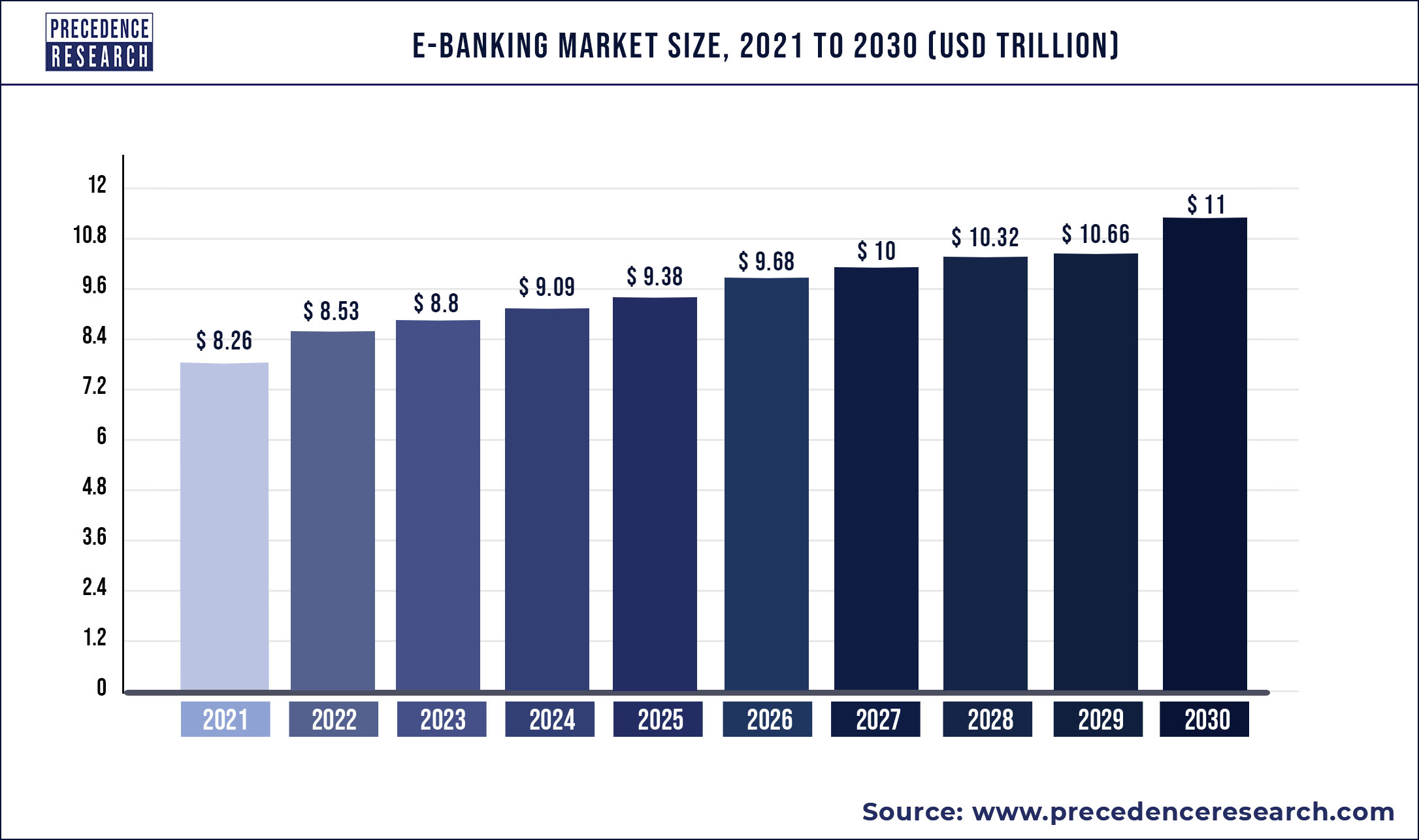

According to Precedence Research, during the forecast period of 2022 to 2030, the global e-banking market is estimated to develop at a compound annual growth rate (CAGR) of 5%. The global e-banking market was valued at USD 8.26 trillion in 2021, and it is predicted to exceed USD 11 trillion by 2030. The study investigates several elements and their consequences on the growth of the e-banking market.

Download Free Sample Copy with TOC@ https://www.precedenceresearch.com/sample/1771

This report focuses on e-banking market volume and value at the global level, regional level and company level. From a global perspective, this report represents overall e-banking market size by analyzing historical data and future prospect. Regionally, this report focuses on several key regions: North America, Europe, Middle East & Africa, Latin America, etc.

| Report Coverage | Details |

| Market Size by 2030 | USD 11 Trillion |

| Growth Rate from 2022 to 2030 | CAGR of 11% |

| Asia Pacific Market Share in 2021 | 30% |

| Fastest Growing Region | North America |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segments Covered | Type, Application, Software, Geography |

The research report includes specific segments by region (country), by company, by all segments. This study provides information about the growth and revenue during the historic and forecasted period of 2017 to 2030. Understanding the segments helps in identifying the importance of different factors that aid the market growth.

In-Depth Analysis on Competitive Landscape

The report sheds light on leading manufacturers of e-banking, along with their detailed profiles. Essential and up-to-date data related to market performers who are principally engaged in the production of e-banking has been brought with the help of a detailed dashboard view. Market share analysis and comparison of prominent players provided in the report permits report readers to take preemptive steps in advancing their businesses.

Company profiles have been included in the report, which include essentials such as product portfolio, key strategies, along with all-inclusive SWOT analysis on each player. Company presence is mapped and presented through a matrix for all the prominent players, thus providing readers with actionable insights, which helps in thoughtfully presenting market status and predicting the competition level in the e-banking market.

Some of the prominent players in the e-banking market include:

- ACI

- Microsoft

- Rockall technologies

- EdgeVerve systems

- Finserv

- Tata Consultancy Services

- Oracle

- Capital banking

- CGI

- Cor financial solutions

- Temenos

Ask Here For More Customization Study@ https://www.precedenceresearch.com/customization/1771

Segments Covered in the Report

By Type

- Retail banking

- Corporate-banking

- Investment banking

By Application

- Payments

- Processing services

- Risk management

- Customer and channel management

- Others

By Software

- Customized Software

- Standard Software

Regional Segmentation

- Asia-Pacific [China, Southeast Asia, India, Japan, Korea, Western Asia]

- Europe [Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

- North America [United States, Canada, Mexico]

- South America [Brazil, Argentina, Columbia, Chile, Peru]

- Middle East & Africa [GCC, North Africa, South Africa]

Some of the important ones are:

- What can be the best investment choices for venturing into new product and service lines?

- What value propositions should businesses aim at while making new research and development funding?

- Which regulations will be most helpful for stakeholders to boost their supply chain network?

- Which regions might see the demand maturing in certain segments in near future?

- What are the some of the best cost optimization strategies with vendors that some well-entrenched players have gained success with?

- Which are the key perspectives that the C-suite are leveraging to move businesses to new growth trajectory?

- Which government regulations might challenge the status of key regional markets?

- How will the emerging political and economic scenario affect opportunities in key growth areas?

- What are some of the value-grab opportunities in various segments?

- What will be the barrier to entry for new players in the market?

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on E-banking Market

5.1. COVID-19 Landscape: E-banking Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global E-banking Market, By Type

8.1. E-banking Market, by Type, 2022-2030

8.1.1 Retail banking

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Corporate-banking

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Investment banking

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global E-banking Market, By Application

9.1. E-banking Market, by Application, 2022-2030

9.1.1. Payments

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Processing services

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Risk management

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Customer and channel management

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global E-banking Market, By Software

10.1. E-banking Market, by Software, 2022-2030

10.1.1. Customized Software

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Standard Software

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global E-banking Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by Software (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Software (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Software (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by Software (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Software (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Software (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Software (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Software (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by Software (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Software (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Software (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Software (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Software (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by Software (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Software (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Software (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Software (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Software (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by Software (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Software (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Software (2017-2030)

Chapter 12. Company Profiles

12.1.ACI

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Microsoft

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Rockall technologies

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. EdgeVerve systems

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Finserv

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Tata Consultancy Services

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Oracle

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Capital banking

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. CGI

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Cor financial solutions

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Buy This Premium Research Report Click Here@ https://www.precedenceresearch.com/checkout/1771

About Us

Precedence Research is a Canada/India based company and one of the leading providers of strategic market insights. We offer executive-level blueprints of markets and solutions beyond flagship surveys. Our repository covers consultation, syndicated market studies, and customized research reports. Through our services we aim at connecting an organization’s goal with lucrative prospects globally.

From gauging investment feasibility to uncovering hidden growth opportunities, our market studies cover in-depth analysis, which also is interspersed with relevant statistics. Recommendation are often enclosed within our reports with the sole intent of enabling organizations achieve mission-critical success.

Contact Us:

Precedence Research

Apt 1408 1785 Riverside Drive Ottawa, ON, K1G 3T7, Canada

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Website: https://www.precedenceresearch.com