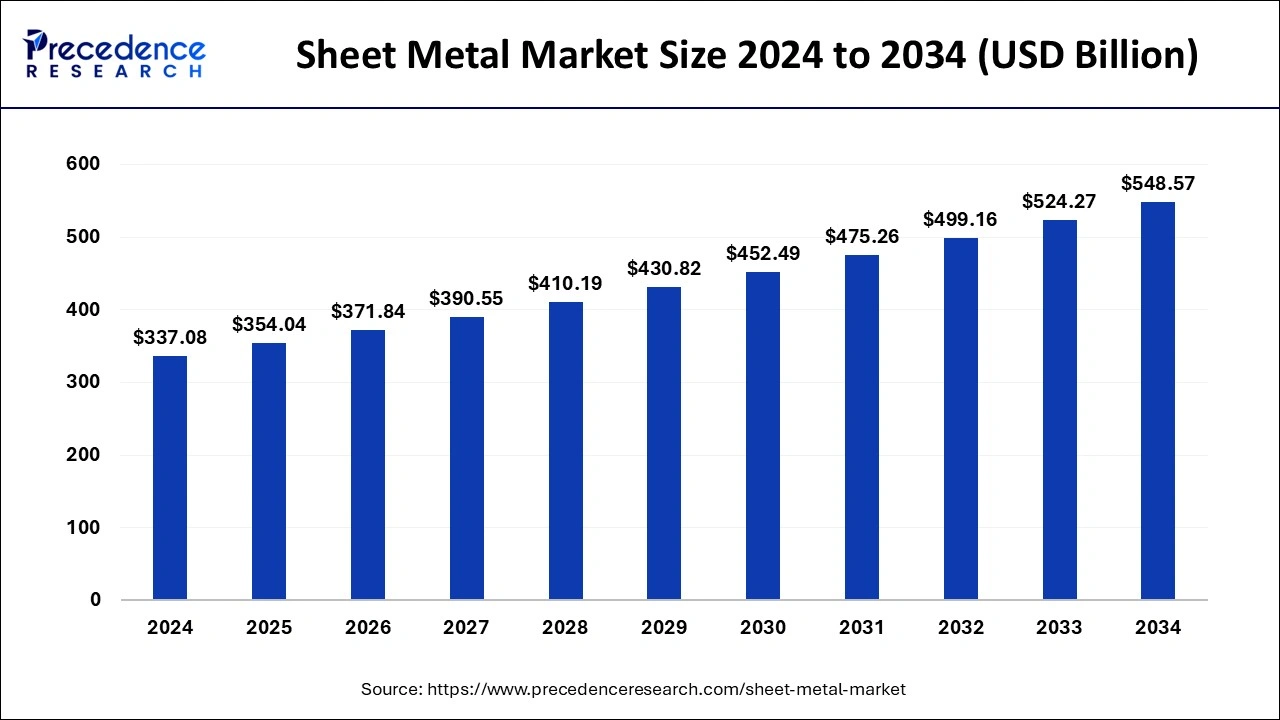

The global sheet metal market size was valued at USD 320.94 billion in 2023 and is predicted to reach around USD 524.27 billion by 2033, at a CAGR of 5.03% from 2024 to 2033.

Key Points

- Asia Pacific dominated the market with the largest revenue share of 62% in 2023.

- North America is estimated to expand at a CAGR of 4.8% during the forecast period of 2024-2033.

- By material type, the steel segment has held a major revenue share of 93% in 2023.

- By material type, the aluminum segment is expected to be the fastest-growing during the forecast period.

- By end-use type, the building and construction segment has contributed more than 56% of revenue share in 2023.

- By end-use type, the automotive and transportation segment is anticipated to be the fastest growing during the forecast period.

The sheet metal market is a significant segment within the broader materials industry, encompassing the production and distribution of thin, flat pieces of metal used in various applications. These metals are typically formed into sheets through industrial processes such as rolling, drawing, and extrusion, and they include materials such as steel, aluminum, brass, copper, and titanium. Sheet metal is fundamental to the manufacturing of a wide array of products, from automotive bodies and aircraft panels to household appliances and construction materials. The market’s scope covers the entire supply chain, from raw material suppliers and metal fabricators to end-users in diverse industries.

Get a Sample: https://www.precedenceresearch.com/sample/4465

Growth Factors

Several factors contribute to the growth of the sheet metal market. One of the primary drivers is the increasing demand from the automotive and aerospace industries. These sectors require large quantities of sheet metal for manufacturing vehicles and aircraft, driven by the rising global population, urbanization, and increasing disposable incomes, which boost demand for personal and commercial vehicles. Additionally, the ongoing trend towards lightweight and fuel-efficient vehicles propels the use of advanced high-strength steels and aluminum in automotive manufacturing.

The construction industry is another significant growth driver. As urbanization continues to accelerate, particularly in developing economies, the demand for residential, commercial, and infrastructure projects increases, boosting the need for sheet metal products. Moreover, the growing trend towards sustainable and green building practices encourages the use of energy-efficient materials, where sheet metal plays a crucial role due to its recyclability and durability.

Technological advancements also play a crucial role in market growth. Innovations in manufacturing processes, such as laser cutting, automation, and computer-aided design (CAD) technologies, enhance the efficiency and precision of sheet metal fabrication. These advancements reduce production costs, improve product quality, and enable the creation of more complex and customized designs, thereby expanding the applications of sheet metal across various industries.

Trends

Several notable trends are shaping the sheet metal market. One of the prominent trends is the shift towards lightweight materials. With the automotive and aerospace industries focusing on reducing the weight of their products to enhance fuel efficiency and reduce emissions, there is a growing preference for aluminum and high-strength steel over traditional steel. This shift is further supported by advancements in material science that improve the strength-to-weight ratio of these metals.

Another trend is the increasing adoption of automation and smart manufacturing technologies. The integration of robotics, artificial intelligence (AI), and the Internet of Things (IoT) in sheet metal fabrication processes is revolutionizing the industry. These technologies enable real-time monitoring, predictive maintenance, and improved production efficiency, resulting in higher output and lower operational costs.

Sustainability is also a key trend influencing the market. With growing environmental concerns and stringent regulations regarding carbon emissions and waste management, manufacturers are adopting eco-friendly practices. This includes using recycled materials, implementing energy-efficient production processes, and developing products with longer lifespans and better recyclability. The emphasis on sustainability is not only driven by regulatory requirements but also by increasing consumer awareness and demand for environmentally responsible products.

Region Insights

The sheet metal market exhibits varying dynamics across different regions. North America, particularly the United States, is a major market due to its robust automotive and aerospace industries. The presence of leading automotive manufacturers and aerospace companies drives the demand for high-quality sheet metal products. Additionally, the region’s focus on technological innovation and advanced manufacturing practices supports market growth.

Europe is another significant market, characterized by strong demand from the automotive and construction sectors. Germany, being a hub for automotive manufacturing, plays a pivotal role in the region’s market. The European Union’s stringent regulations on emissions and waste management further promote the use of sustainable and lightweight materials in the region.

The Asia-Pacific region is expected to witness the fastest growth in the sheet metal market. Rapid industrialization, urbanization, and economic development in countries like China, India, and Japan drive the demand for sheet metal products. The region’s expanding automotive industry, coupled with significant infrastructure development projects, fuels market growth. Additionally, the availability of raw materials and low-cost labor makes Asia-Pacific a favorable region for sheet metal manufacturing.

Latin America and the Middle East & Africa also present growth opportunities, although at a comparatively slower pace. In Latin America, Brazil and Mexico are key markets due to their growing automotive and construction sectors. The Middle East & Africa region benefits from infrastructure development and investments in the oil and gas industry, which drive the demand for sheet metal products.

Sheet Metal Market Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 320.94 Billion |

| Market Size in 2024 | USD 337.08 Billion |

| Market Size by 2033 | USD 524.27 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 5.03% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Material Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Sheet Metal Market Dynamics

Drivers

Several drivers are propelling the growth of the sheet metal market. The automotive industry’s expansion is a major driver, with increasing vehicle production and sales driving the demand for sheet metal. The trend towards electric vehicles (EVs) also contributes to market growth, as EV manufacturers require lightweight materials to enhance vehicle range and performance.

The construction industry’s growth, driven by urbanization and infrastructure development, is another key driver. Sheet metal is extensively used in building construction for applications such as roofing, cladding, and structural components. The adoption of modern construction techniques and the emphasis on energy-efficient buildings further boost the demand for sheet metal products.

Technological advancements in manufacturing processes enhance the capabilities of sheet metal fabrication, making it possible to produce complex and high-precision components. The adoption of automation and digital technologies improves production efficiency and reduces costs, making sheet metal products more competitive in the market.

The increasing focus on sustainability and environmental regulations also drives the market. The recyclability of sheet metal makes it an attractive material for various applications, aligning with the global shift towards circular economy practices. The demand for eco-friendly materials and energy-efficient products further supports the growth of the sheet metal market.

Opportunities

The sheet metal market offers several growth opportunities. The rising demand for electric vehicles (EVs) presents a significant opportunity for sheet metal manufacturers. EVs require lightweight materials to improve battery efficiency and extend driving range, leading to increased use of aluminum and high-strength steel. Collaborations with EV manufacturers and investments in advanced material technologies can help sheet metal companies capitalize on this growing market.

The renewable energy sector also offers opportunities for growth. The increasing adoption of solar panels and wind turbines drives the demand for sheet metal components used in these technologies. The development of more efficient and durable materials for renewable energy applications can open new revenue streams for sheet metal manufacturers.

Expanding into emerging markets presents another opportunity. Rapid industrialization and urbanization in regions such as Asia-Pacific, Latin America, and Africa create a growing demand for sheet metal products. Establishing a strong presence in these regions through partnerships, joint ventures, or setting up manufacturing facilities can help companies tap into these burgeoning markets.

Investing in research and development (R&D) to develop innovative products and improve existing ones is also crucial. The development of new alloys and composites with enhanced properties can meet the evolving needs of various industries, from automotive and aerospace to construction and electronics. R&D efforts focused on sustainability, such as developing biodegradable or more easily recyclable materials, can also create competitive advantages.

Challenges

Despite the growth opportunities, the sheet metal market faces several challenges. Fluctuations in raw material prices can significantly impact production costs and profit margins. The volatility in the prices of metals such as steel, aluminum, and copper can create uncertainties for manufacturers, making it challenging to manage costs and maintain pricing strategies.

Stringent environmental regulations and standards pose another challenge. Compliance with these regulations requires substantial investments in sustainable practices and technologies. The need to reduce emissions, manage waste, and use eco-friendly materials can increase operational costs and require ongoing adaptation to regulatory changes.

The competitive landscape of the sheet metal market is also challenging. The presence of numerous players, ranging from large multinational corporations to small and medium-sized enterprises, creates intense competition. Companies must continuously innovate, improve efficiency, and maintain high-quality standards to stay competitive in the market.

Technological advancements, while beneficial, also present challenges. The rapid pace of technological change requires continuous investments in new equipment and skills development. Keeping up with the latest manufacturing technologies, such as automation, AI, and IoT, can be costly and requires a skilled workforce capable of operating and maintaining advanced systems.

Read Also: Chemical Catalyst Market Size to Reach USD 61.46 Bn By 2033

Sheet Metal Market Companies

- Constellium

- Kaiser Aluminum

- Alcoa Corporation

- Arconic

- Baosteel Group

- JFE Steel Corporation

- United States Steel

- POSCO

- Nippon Steel Corporation

- Tata Bluescope Steel

- JSW

Recent Developments

- In June 2022, a global leader in industrial metrology solutions, ZEISS, announced the opening of IMTEX 2022, and the flagship exhibition was arranged by IMTMA. The 3- products were launched: COUNTRUA, METROTOM 1, and SURFCOM NEX 200 SD2. They demonstrated a large range of Metrology solutions that help with sheet metal forming.

- In September 2022, a new digital sheet metal forming technology with Figur G15, which has a high-quality surface finish at IMTS, was announced by Desktop Metal. This new technology does not require post-processing like presses, dies, molds, and stamping tools.

Segments Covered in the Report

By Material Type

- Steel

- Aluminum

- Others

By End-Use

- Automotive & Transportation

- Building & Construction

- Industrial Machinery

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/