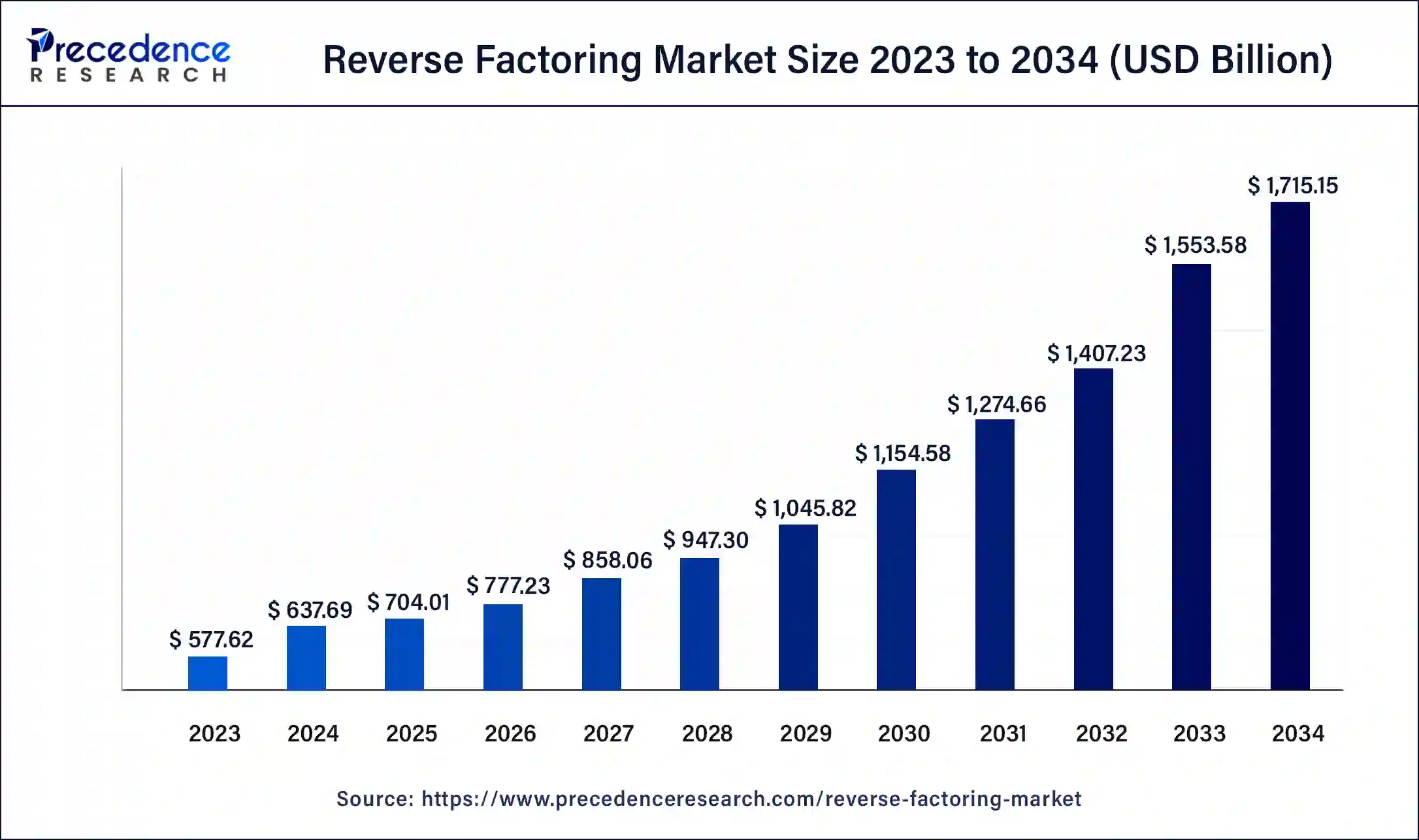

The global reverse factoring market size is projected to hit around USD 1,527.05 billion by 2033, expanding at a CAGR of 10.21% from 2024 to 2033.

Key Points

- Europe has contributed more than 50% of market share in 2023.

- By category, the domestic segment held the largest market share in 2023.

- By category, the international segment is anticipated to grow at a remarkable CAGR between 2024 and 2033.

- By financial institution, the bank segment has generated the biggest market share in 2023.

- By financial institution, the non-banking financial institutions segment is expected to expand at the fastest CAGR over the projected period.

- By end-use, the manufacturing segment has led the significant market share in 2023.

- By end-use, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

The reverse factoring market, also known as supply chain finance, is a financial arrangement that enables companies to optimize their working capital by extending payment terms to their suppliers while providing early payment options through a third-party financing provider. In this arrangement, the financing provider, often a bank or a financial institution, pays the suppliers on behalf of the buyer, allowing them to receive payment sooner than the agreed-upon payment terms. The buyer then repays the financing provider at a later date, typically with an interest or fee.

Get a Sample: https://www.precedenceresearch.com/sample/3985

One of the key drivers behind the growth of the reverse factoring market is the increasing focus on working capital optimization among businesses across various industries. By extending payment terms to suppliers without negatively impacting their cash flow, buyers can improve their own liquidity position and strengthen their relationships with suppliers. This has led to a rise in demand for reverse factoring solutions as companies seek to unlock trapped liquidity within their supply chains.

Additionally, regulatory changes and accounting standards have also contributed to the growth of the reverse factoring market. With the implementation of regulations such as Basel III and IFRS 9, there has been a greater emphasis on transparency and risk management in financial transactions. Reverse factoring offers companies a way to enhance their balance sheet efficiency and manage liquidity risk effectively, making it an attractive option for businesses seeking to comply with regulatory requirements while optimizing their working capital.

Reverse Factoring Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.21% |

| Global Market Size in 2023 | USD 577.62 Billion |

| Global Market Size by 2033 | USD 1,527.05 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Category, By Financial Institution, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Reverse Factoring Market Dynamics

Furthermore, technological advancements have played a significant role in shaping the reverse factoring market landscape. The development of digital platforms and fintech solutions has made it easier for companies to implement and manage supply chain finance programs. These platforms streamline the onboarding process for suppliers, automate invoicing and payment processes, and provide real-time visibility into cash flows, enhancing efficiency and transparency in the supply chain finance ecosystem.

From a regional perspective, the reverse factoring market has witnessed significant growth in regions with robust manufacturing and export sectors, such as Asia-Pacific and Europe. In these regions, large multinational corporations often have extensive supplier networks spanning multiple countries, making supply chain finance an attractive option for optimizing working capital and mitigating financial risks associated with global supply chains.

Despite its benefits, the reverse factoring market also faces several challenges and risks. One of the main concerns is the potential for supplier dependence on reverse factoring arrangements, which can lead to increased financial fragility and vulnerability to disruptions in the supply chain. Additionally, there is a risk of supplier exploitation if buyers use reverse factoring as a means to impose onerous payment terms on their suppliers, potentially leading to ethical and reputational issues.

Read Also: Aviation IoT Market Size to Attain USD 69.51 Billion by 2033

Recent Developments

- In October 2022, HSBC Hong Kong, a wholly-owned subsidiary of the HSBC Group, unveiled Trade Platform, a comprehensive e-platform designed to offer flexibility, safety, and security in managing global trade transactions. It caters to trade loans for sellers and buyers, guarantees, import bills, and import documents for credit.

- In December 2022, Endesa, in collaboration with Banco Bilbao Vizcaya Argentaria, Caixabank, and Santander, introduced a circular reverse factoring solution. This innovative initiative includes incentives and rewards for sustainable practices, thereby enhancing their competitiveness within the economy.

Reverse Factoring Market Companies

- Citibank

- HSBC

- Santander

- Banco Bilbao Vizcaya Argentaria (BBVA)

- Caixabank

- JPMorgan Chase

- Bank of America

- BNP Paribas

- Deutsche Bank

- Barclays

- Société Générale

- Credit Suisse

- ING Group

- Wells Fargo

- Standard Chartered

Segments Covered in the Report

By Category

- Domestic

- International

By Financial Institution

- Banks

- Non-banking Financial Institutions

By End-use

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Others (Retail, Food & Beverages, Among Others)

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/