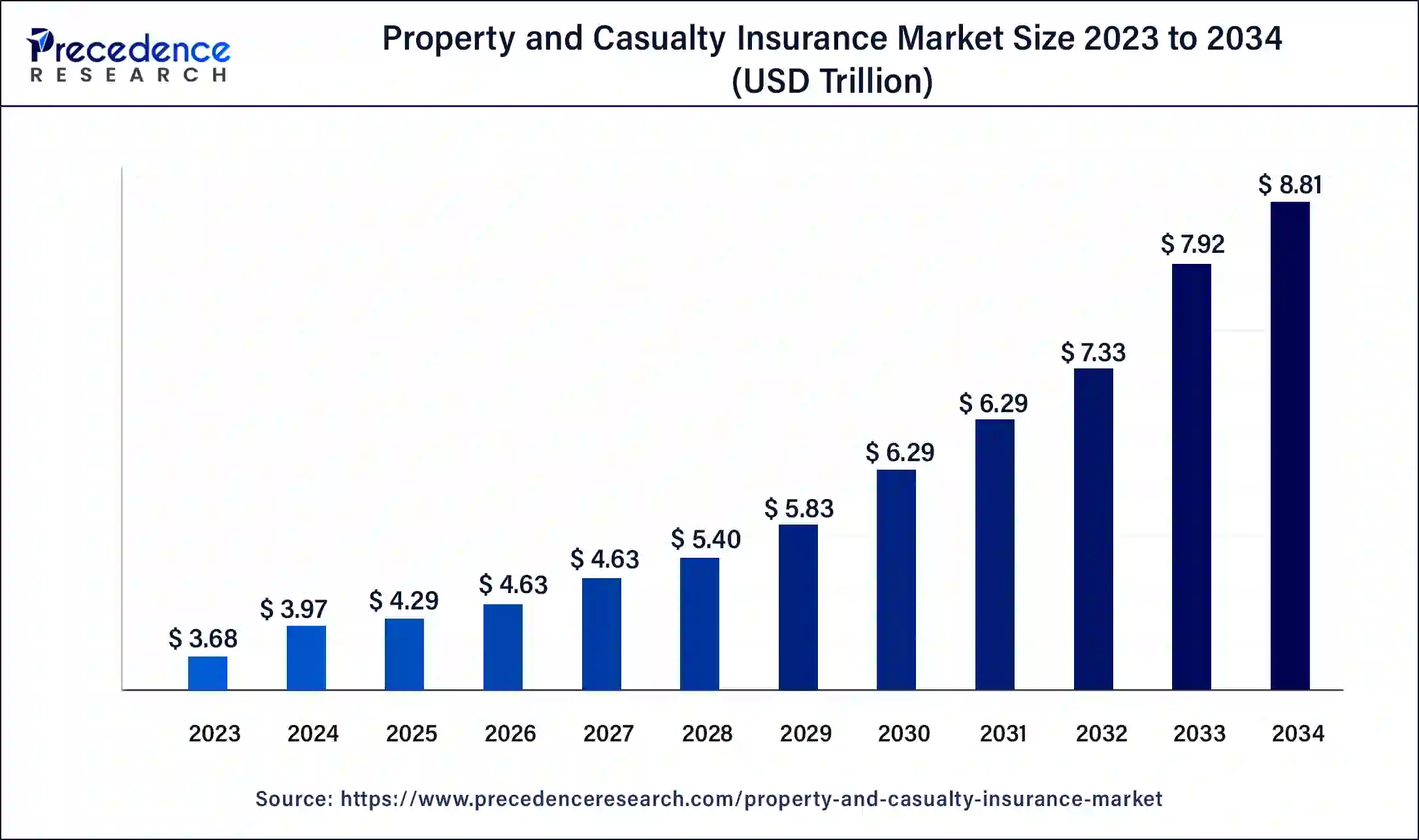

The global property and casualty insurance market size is projected to grow around USD 7.92 trillion by 2033, growing at a CAGR of 7.96% from 2024 to 2033.

Key Points

- The North America property and casualty insurance market size was calculated at USD 1.18 trillion in 2023 and is expected to attain around USD 2.53 trillion by 2033.

- North America led the market with the largest market share of 32% in 2023.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By product, the homeowners insurance segment has held the largest market share of 38% in 2023.

- By distribution, the brokers segment dominated the market in 2023.

- By distribution, the tied agents and branches segment is expected to grow at the fastest rate during the forecast period.

- By end-users, the individual segment has accounted more than 57% of market share in 2023.

- By end-users, the business segment is expected to grow at the fastest rate during the forecast period.

The property and casualty insurance market encompasses a broad range of insurance products designed to protect individuals, businesses, and assets from financial losses due to property damage, liability claims, and other risks. Property insurance covers physical assets such as homes, vehicles, and commercial properties, while casualty insurance provides liability coverage for injuries or damages caused to third parties. This market plays a crucial role in risk management and financial protection, serving both personal and commercial insurance needs.

Growth Factors: Several factors contribute to the growth of the property and casualty insurance market. Economic expansion and urbanization drive demand for property insurance as individuals and businesses seek to protect their assets against various risks, including natural disasters, theft, and accidents. Moreover, regulatory mandates requiring insurance coverage, such as auto liability insurance for drivers, contribute to market growth. Advances in technology, such as telematics and predictive analytics, also enable insurers to better assess risks, price policies accurately, and streamline claims processing, fostering market growth.

Get a Sample: https://www.precedenceresearch.com/sample/4156

Region Insights:

The property and casualty insurance market exhibits regional variations influenced by factors such as economic development, regulatory environment, and natural disaster risks. In mature markets like North America and Western Europe, high insurance penetration rates and stringent regulatory standards drive market stability and innovation. Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities due to rising incomes, urbanization, and increasing awareness of insurance products. However, these markets also face challenges such as regulatory complexities, infrastructure limitations, and catastrophe risks.

Property and Casualty Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.96% |

| Global Market Size in 2023 | USD 3.68 Trillion |

| Global Market Size in 2024 | USD 3.97 Trillion |

| Global Market Size by 2033 | USD 7.92 Trillion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Distribution, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Property and Casualty Insurance Market Dynamics

Drivers:

Several drivers propel the property and casualty insurance market forward. Changing demographics, such as population growth and aging populations, drive demand for insurance products like homeowners and long-term care insurance. Additionally, increasing frequency and severity of natural disasters and climate-related events heighten awareness of the need for comprehensive property insurance coverage. Technological advancements, including the Internet of Things (IoT) and artificial intelligence, enable insurers to offer innovative products, personalized services, and more efficient claims handling, enhancing customer satisfaction and market competitiveness.

Opportunities:

The property and casualty insurance market presents numerous opportunities for insurers to expand their customer base, enhance product offerings, and improve operational efficiency. Innovations such as usage-based insurance, peer-to-peer insurance, and parametric insurance create new revenue streams and cater to evolving customer needs. Moreover, partnerships with technology firms and insurtech startups facilitate digital transformation and enable insurers to leverage data analytics and automation for risk assessment and underwriting. Expansion into underserved markets and diversification of product portfolios also offer growth opportunities for insurers seeking to tap into emerging trends and customer segments.

Challenges:

Despite growth opportunities, the property and casualty insurance market faces several challenges. Intense competition among insurers exerts pressure on premiums and profitability, particularly in mature markets. Regulatory compliance requirements, including solvency standards and consumer protection regulations, add complexity and cost to insurance operations. Moreover, evolving risks such as cyber threats and pandemics present new challenges for insurers in assessing and pricing risks accurately. Additionally, climate change and natural catastrophes pose significant financial risks to insurers, necessitating effective risk management strategies and capital reserves to withstand large-scale losses.

Read Also: Irradiation Sterilization Services Market Size, Trends, Report By 2033

Property and Casualty Insurance Market Recent Developments

- In March 2024, Chubb launched a global transactional risk platform to offer transactional risk liability insurance products across international markets.

- In November 2023, Futuristic Underwriters and Tech-Driven MGA launched commercial P&C insurance to reduce risk and drive profitability for agents, insurers, and insureds.

- In January 2024, New MGA, a team of experts TLI, launched Sands Point Risk to support expanded opportunities in financial and property-casualty insurance lines.

- In April 2024, Beat Capital Partners is set to launch Convergence, a credit insurance company led by Stephen Pike, the founder and CEO.

- In March 2024, Future Generali India Insurance, a private general insurer, has recently launched a new product called Health PowHER that caters to the healthcare needs of women at various stages of their lives. This product provides coverage for a range of women-specific medical conditions, including increased limits for cancer treatments specific to females, and coverage for disorders related to puberty and menopause.

Property and Casualty Insurance Market Companies

- Chubb

- USAA Insurance Company

- The Travelers Indemnity Company

- CNA Financial Corp.

- Liberty Mutual Insurance Company

- Farmers Insurance Group of Companies

- State Farm Mutual Automobile Insurance Company

- Berkshire Hathaway Specialty Insurance

- Progressive Casualty Insurance Company

- Allstate Insurance Company

Segments Covered in the Report

By Product

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Landlord Insurance

- Others

By Distribution

- Tied Agents and Branches

- Brokers

- Others

By End-users

- Individuals

- Governments

- Businesses

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/