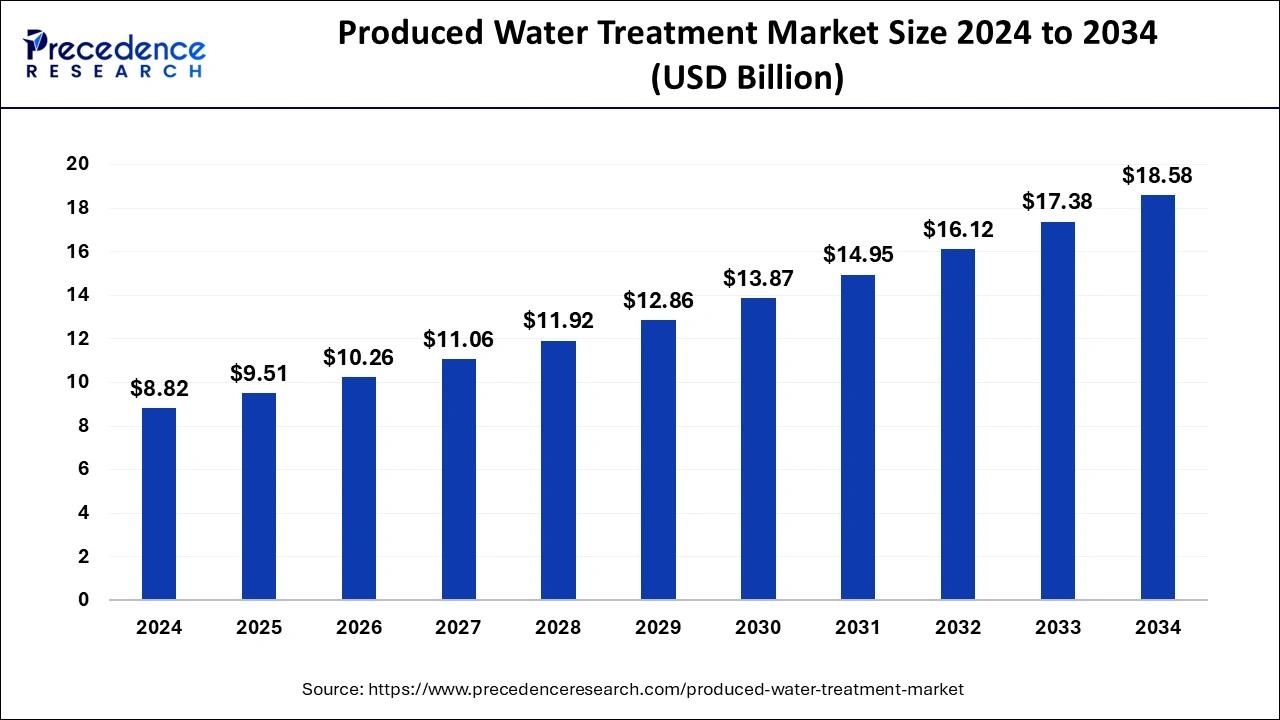

The global produced water treatment market size was valued at USD 8.18 billion in 2023 and is expected to reach around USD 17.38 billion by 2033, expanding at a CAGR of 7.83% from 2024 to 2033.

Key Points

- The North America produced water treatment market size is exhibited at USD 3.52 billion in 2023 and is expected to attain around USD 7.56 billion by 2033, poised to grow at a CAGR of 7.94% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 43% in 2023.

- Europe is expected to host the fastest-growing market during the forecast period.

- By application, the on-shore segment has held a major revenue share of 72% in 2023.

- By application, the off-shore segment is expected to witness the fastest growth in the market.

- By treatment, the physical treatment segment has contributed more than 48% of revenue share in 2023.

- By treatment, the chemical treatment segment is expected to expand rapidly in the market during the forecast period.

The produced water treatment market is an integral segment of the global water treatment industry, primarily focused on treating water that is produced during the extraction of oil and gas. Produced water, a byproduct of oil and gas exploration and production, contains various contaminants including hydrocarbons, dissolved metals, and chemicals used in drilling processes. The need to treat produced water arises from environmental regulations, as untreated discharge can harm ecosystems and human health.

Get a Sample: https://www.precedenceresearch.com/sample/4474

Growth Factors

Several key factors drive the growth of the produced water treatment market. Firstly, stringent environmental regulations worldwide compel oil and gas companies to treat and manage produced water responsibly. Governments impose strict limits on the discharge of contaminants into water bodies, encouraging investments in advanced treatment technologies. Additionally, technological advancements in treatment methods such as membrane filtration, chemical treatments, and electrochemical processes enhance the efficiency and effectiveness of produced water treatment systems, driving market growth.

Moreover, the increasing global demand for oil and gas amplifies the volume of produced water generated, thereby expanding the market for treatment solutions. The rise in offshore oil and gas exploration activities further boosts demand, as offshore platforms often face more stringent regulatory requirements and logistical challenges for water disposal. These growth factors collectively contribute to the expansion of the produced water treatment market.

Regional Insights

The market for produced water treatment solutions exhibits regional variations influenced by regulatory frameworks, industrial activities, and environmental concerns. North America, particularly the United States and Canada, dominates the market due to extensive shale gas production and stringent environmental regulations. The region’s focus on advanced technologies and large-scale oil and gas operations drives significant investments in produced water treatment.

In Europe, regulatory initiatives under the European Union’s Water Framework Directive and other environmental directives shape the market dynamics. Countries like Norway and the UK lead in offshore oil production, necessitating sophisticated water treatment solutions to comply with strict discharge limits. Asia-Pacific showcases rapid market growth driven by expanding oil and gas activities in countries such as China, India, and Australia. These regions invest in innovative treatment technologies to address water scarcity and environmental concerns associated with oil and gas exploration.

Trends in the Produced Water Treatment Market

Several trends influence the evolution of the produced water treatment market. One notable trend is the increasing adoption of modular and mobile treatment units. These units offer flexibility and scalability, allowing oil and gas operators to deploy treatment systems quickly and cost-effectively, particularly in remote or temporary operations. Another trend is the integration of digital technologies such as IoT (Internet of Things) and AI (Artificial Intelligence) in water treatment processes. These technologies enhance operational efficiency, optimize resource utilization, and improve predictive maintenance capabilities in treatment facilities.

Additionally, there is a growing emphasis on sustainable water management practices within the industry. Companies are increasingly investing in water reuse and recycling technologies to minimize freshwater consumption and reduce the environmental footprint of oil and gas operations. This trend aligns with global sustainability goals and enhances corporate social responsibility initiatives across the sector.

Produced Water Treatment Market Scope

| Report Coverage | Details |

| Market Size by 2033 | USD 17.38 Billion |

| Market Size in 2023 | USD 8.18 Billion |

| Market Size in 2024 | USD 8.82 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 7.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Application, Treatment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Produced Water Treatment Market Dynamics

Drivers

Several drivers propel the growth of the produced water treatment market. Firstly, the escalating global demand for energy drives increased oil and gas production, consequently boosting the volume of produced water requiring treatment. Strict regulatory standards imposed by governments worldwide mandate the adoption of effective treatment technologies to mitigate environmental impacts and ensure compliance.

Furthermore, advancements in treatment technologies, such as membrane filtration, reverse osmosis, and electrochemical processes, offer efficient and cost-effective solutions for treating complex wastewater streams. These technological innovations expand the market’s scope by addressing the diverse needs of oil and gas operators, from onshore to offshore environments. Moreover, the integration of decentralized treatment systems enables operational flexibility and reduces logistical challenges associated with centralized treatment facilities.

Opportunities

The produced water treatment market presents numerous opportunities for stakeholders across the value chain. Expansion opportunities abound in emerging markets with burgeoning oil and gas sectors, where there is a growing demand for reliable and sustainable water treatment solutions. Technological advancements continue to create opportunities for innovation, particularly in enhancing treatment efficiency, reducing operational costs, and minimizing environmental impacts.

Moreover, partnerships and collaborations between technology providers, oil and gas companies, and research institutions foster innovation and market growth. These collaborations facilitate the development of tailored solutions that address specific challenges faced by the industry, such as treating water with high salinity or complex chemical compositions. Additionally, the increasing focus on water reuse and recycling presents a significant opportunity for developing cost-effective and environmentally sustainable treatment solutions.

Challenges

Despite its growth prospects, the produced water treatment market faces several challenges. One of the primary challenges is the high operational costs associated with advanced treatment technologies. The capital-intensive nature of installing and maintaining treatment systems, coupled with energy and chemical consumption, poses financial challenges for oil and gas operators, particularly during periods of low commodity prices.

Moreover, regulatory uncertainty and evolving standards present challenges for companies navigating compliance requirements across different jurisdictions. Variations in regulatory frameworks and enforcement practices necessitate continuous adaptation and investment in compliance management strategies. Additionally, the complexity of treating produced water with varying compositions and contaminants requires ongoing research and development efforts to enhance treatment effectiveness and reliability.

Furthermore, the logistical challenges of treating produced water in remote or offshore locations contribute to operational complexities and cost considerations. Transportation and infrastructure limitations in these environments can impact the feasibility and efficiency of treatment operations. Overcoming these challenges requires collaboration among stakeholders to develop robust solutions that balance environmental stewardship with operational efficiency and economic viability.

Read Also: Gift Packaging Market Size to Hit USD 38.93 Bn By 2033

Produced Water Treatment Market Companies

- Godrej Consumer Products Ltd.

- S. C. Johnson & Son

- Dabur India Ltd.

- Reckitt Benckiser.

- Spectrum Brands Holdings Inc.

Recent Developments

- In December 2023, In order to advance as a comprehensive water solution firm in the international market, Samyang Corporation, the pioneer in the development of ion exchange resin in Korea and a leader in the field of industrial water treatment materials, has introduced two new products and formed a specialized organization.

- In February 2023, through its Xylem Innovation Labs commercial accelerator program, multinational water technology corporation Xylem is fostering the growth of up-and-coming startups and expediting the creation of game-changing technologies. The program, which is in its second year, has just accepted ten new businesses.

Segment Covered in the Report

By Application

- Onshore

- Offshore

By Treatment

- Physical Treatment

- Chemical Treatment

- Biological Treatment

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/