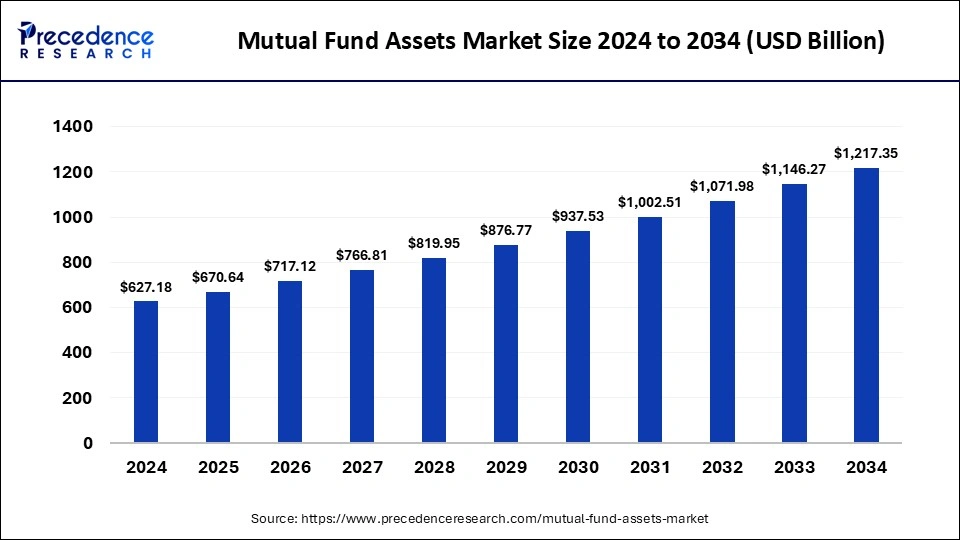

The global mutual fund assets market size was estimated at USD 586.53 billion in 2023 and is predicted to be worth around USD 1,146.27 billion by 2033, growing at a CAGR of 6.93% from 2024 to 2033.

Key Points

- The North America mutual fund assets market size accounted for USD 199.42 billion in 2023 and is expected to attain around USD 395.46 billion by 2033, poised to grow at a CAGR of 7.08% between 2024 and 2033.

- North America has held a major revenue share of 34% in 2023.

- Asia Pacific is expected to host the fastest-growing market during the forecast period.

- By investment strategy, the equity strategy segment held the largest share of the market in 2023.

- By investment strategy, the sustainable strategy segment is expected to grow rapidly in the market during the forecast period.

- By type, the open-ended segment has contributed more than 84% of revenue share in 2023.

- By type, the close-ended segment is expected to rapidly expand in the global market during the forecast period.

- By distribution channel, the direct sales segment has generated more than 37% of revenue share in 2023.

- By distribution channel, the financial advisors segment is expected to grow rapidly in the market during the forecast period.

- By investment style, the active segment has recorded the largest revenue share of 73% in 2023.

- By investment style, the passive segment is expected to gain a significant share of the market during the forecast period.

- By investor type, the retail segment has held a major revenue share of 60% in 2023.

- By investor type, the institutional segment is expected to grow rapidly in the market during the forecast period.

The mutual fund assets market comprises various types of mutual funds, including equity, bond, hybrid, and money market funds. These funds pool capital from numerous investors to purchase securities, managed by professional fund managers. The market has seen substantial growth due to increasing investor awareness, favorable government policies, and technological advancements in financial services. Mutual funds provide investors with diversification, liquidity, and professional management, making them a popular investment choice.

Get a Sample: https://www.precedenceresearch.com/sample/4409

Growth Factors

Several factors contribute to the growth of the mutual fund assets market. One significant factor is the rising middle-class population with disposable income and a growing interest in investment options beyond traditional savings accounts. Technological advancements, such as online platforms and mobile apps, have made investing in mutual funds more accessible and convenient. Additionally, regulatory support and tax benefits associated with certain mutual fund investments have incentivized individuals to participate in the market.

Region Insights

The mutual fund market shows varying trends across different regions. North America, particularly the United States, holds a significant share due to a well-established financial infrastructure and a high level of investor participation. Europe follows closely, with countries like the UK and Germany being prominent players. In Asia-Pacific, emerging economies such as India and China are witnessing rapid growth in mutual fund assets, driven by economic development and increasing financial literacy. Each region has unique regulatory environments and investor preferences, influencing market dynamics.

Mutual Fund Assets Market Scope

| Report Coverage | Details |

| Mutual Fund Assets Market Size in 2023 | USD 586.53 Billion |

| Mutual Fund Assets Market Size in 2024 | USD 627.18 Billion |

| Mutual Fund Assets Market Size by 2033 | USD 1,146.27 Billion |

| Mutual Fund Assets Market Growth Rate | CAGR of 6.93% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Investment Strategy, Type, Distribution Channel, Investment Style, Investor Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mutual Fund Assets Market Dynamics

Drivers

Key drivers of the mutual fund assets market include increased financial literacy and awareness about the benefits of mutual funds, such as diversification and professional management. The shift towards a more digital and transparent financial system has also encouraged investors to explore mutual funds. Moreover, favorable economic conditions and rising disposable incomes have led individuals to seek investment opportunities with higher returns than traditional savings accounts.

Opportunities

The mutual fund assets market presents several opportunities for growth and innovation. The increasing penetration of the internet and mobile technologies offers opportunities for digital platforms to attract new investors, particularly in underserved and remote areas. Additionally, sustainable and socially responsible investing is gaining traction, leading to the development of green and ethical mutual funds. The growing interest in personalized investment solutions also opens avenues for customized mutual fund products tailored to individual risk profiles and financial goals.

Challenges

Despite the positive growth prospects, the mutual fund assets market faces several challenges. Market volatility and economic uncertainties can impact investor confidence and lead to fluctuations in fund flows. Regulatory changes and compliance requirements can pose challenges for fund managers and financial institutions. Additionally, intense competition among mutual fund providers necessitates continuous innovation and cost-efficiency to maintain market share. Educating potential investors about the risks and benefits associated with mutual funds remains a critical challenge to ensure sustained market growth.

Read Also: Electrosurgical Generators Market Size to Reach USD 3.53 Bn by 2033

Mutual Fund Assets Market Recent Developments

- In January 2024, A hybrid fund called the Multi-Asset Allocation Fund was introduced by Bandhan Mutual Fund. It would invest in a variety of asset classes, with 50% of the allocation going into Indian stocks. 10% will go toward actively managed high-quality Fixed Income, 15% will go toward fully hedged arbitrage strategies, 15% will go toward international equities across the US and other developed markets as well as emerging markets, and 10% will go toward domestic gold and silver, according to the fund house.

- In February 2024, HSBC Mutual Fund introduced the HSBC Multi Asset Allocation Fund, an open-ended scheme that invests in debt and money market securities, gold/silver ETFs, and equities and equity-related instruments. The scheme’s new fund offer, or NFO, will be available for subscription starting on February 8 and ending on February 22.

Mutual Fund Assets Market Companies

- Black Rock

- UTI Mutual Fund

- Morgan Stanley

- PIMCO

- DSP Mutual Fund

- Trustee

- JPMorgan Chase & Co

- Capital Group

- Vanguard

Segment Covered in the Report

By Investment Strategy

- Equity Strategy

- Fixed Income Strategy

- Multi-Asset/Balanced Strategy

- Sustainable Strategy

- Money Market Strategy

- Others

By Type

- Open-ended

- Close-ended

By Distribution Channel

- Direct Sales

- Financial Advisor

- Broker-Dealer

- Banks

- Others

By Investment Style

- Active

- Passive

By Investor Type

- Retail

- Institutional

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/