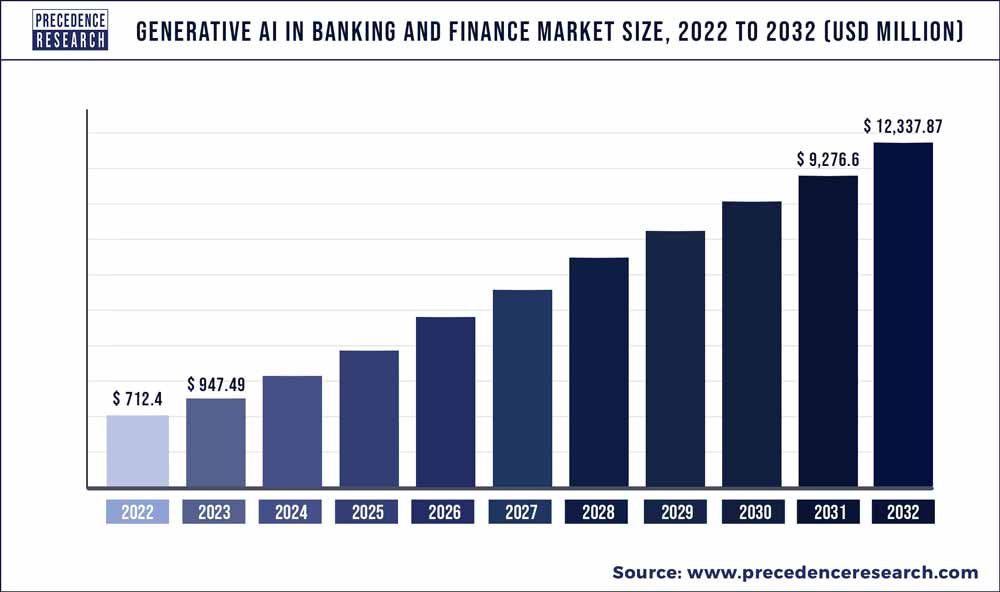

According to a recent research report titled ” Generative AI in Banking and Finance Market (By Technology: Natural Language Processing, Deep Learning, Reinforcement Learning, Generative Adversarial Networks, Computer Vision, Predictive Analytics; By Application: Fraud Detection, Customer Service, Risk Assessment, Compliance, Trading and Portfolio Management) – Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032″ published by Precedence Research, the global generative AI in banking and finance market size is projected to touch around USD 12,337.87 million by 2032 and growing at a CAGR of 33% over the forecast period 2023 to 2032. This comprehensive study examines various factors and their impact on the growth of the GENERATIVE AI IN BANKING AND FINANCE market.

Key Takeaways:

- North America captured more than 37% of revenue share in 2022.

- By technology, the natural language processing segment is expected to grow at a significant rate over the forecast period.

- By application, the fraud detection segment is expected to grow at a significant rate over the forecast period.

The report primarily focuses on the volume and value of the GENERATIVE AI IN BANKING AND FINANCE market at the global, regional, and company levels. At the global level, the report analyzes historical data and future prospects to present an overview of the overall market size. Regionally, the study emphasizes key regions such as North America, Europe, the Middle East & Africa, Latin America, and others.

Furthermore, the research report provides specific segmentations based on regions (countries), companies, and all market segments. This analysis offers insights into the growth and revenue trends during the historical period of 2017 to 2032, as well as the projected period. By understanding these segments, it becomes possible to identify the significance of different factors that contribute to market growth.

Growth Factor:

The surge in generative AI adoption within the Banking Market can be attributed to several key factors. Firstly, banks possess extensive sets of customer data, financial market analyses, transaction records, and historical trends, making them ideal sources for training generative AI models that yield accurate predictions and valuable insights.

The advancements in modern computing power and cloud infrastructure have significantly facilitated the processing and analysis of vast datasets required for generative AI applications. Banks can now leverage scalable cloud platforms and high-performance computing resources to efficiently train and deploy generative AI models.

Another driving force behind the adoption of Generative AI in Banking is the growing emphasis on delivering personalized and seamless customer experiences. By implementing generative AI, banks can develop virtual assistants, chatbots, and personalized recommendation systems, thus fostering deeper customer engagement, providing tailored financial advice, and ultimately enhancing overall satisfaction levels with their products and services.

Moreover, the increasing need for more effective risk management and regulatory compliance solutions has made generative AI an appealing option for banks. Its applications in fraud detection, risk evaluation, and regulatory compliance enable banks to monitor complex patterns and swiftly detect anomalies, thus facilitating real-time identification of potential compliance violations.

Download a Free Copy of Our Latest Sample Report@ https://www.precedenceresearch.com/sample/3138

The research also highlights significant progressions in both organic and inorganic growth strategies within the global generative AI in banking and finance market. Numerous companies are placing emphasis on new product launches, gaining product approvals, and implementing various business expansion tactics. Moreover, the report presents detailed profiles of firms operating in the generative AI in banking and finance market, along with their respective market strategies. Additionally, the study concentrates on prominent industry participants, furnishing details such as company profiles, product offerings, financial updates, and noteworthy advancements.

Generative AI in Banking and Finance Market Report Scope

| Report Coverage | Details |

| Market Size in 2023 | USD 947.49 Million |

| Market Size in 2032 | USD 12,337.87 Million |

| Growth Rate from 2023 to 2032 | CAGR of 33% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Also read: Industrial Fasteners Market Size To Grow USD 153 Billion by 2032

Major Key Points Covered in Report:

Executive Summary: It includes key trends of the electric vehicle fuel cell market related to products, applications, and other crucial factors. It also provides analysis of the competitive landscape and CAGR and market size of the electric vehicle fuel cell market based on production and revenue.

Production and Consumption by Region: It covers all regional markets to which the research study relates. Prices and key players in addition to production and consumption in each regional market are discussed.

Key Players: Here, the report throws light on financial ratios, pricing structure, production cost, gross profit, sales volume, revenue, and gross margin of leading and prominent companies competing in the Electric vehicle fuel cell market.

Market Segments: This part of the report discusses product, application and other segments of the electric vehicle fuel cell market based on market share, CAGR, market size, and various other factors.

Research Methodology: This section discusses the research methodology and approach used to prepare the report. It covers data triangulation, market breakdown, market size estimation, and research design and/or programs.

Market Key Players

The report incorporates company profiles of key players in the market. These profiles encompass vital information such as product portfolio, key strategies, and a comprehensive SWOT analysis for each player. Additionally, the report presents a matrix illustrating the presence of each prominent player, enabling readers to gain actionable insights. This facilitates a thoughtful assessment of the market status and aids in predicting the level of competition in the generative AI in banking and finance market.

Some of the prominent players in the generative AI in banking and finance market include

- Amazon Web Services Inc.

- Cisco Systems Inc.

- Microsoft Corporation

- SAP SE

- BigML Inc.

- Fair Isaac Corporation

- IBM Corporation

- Google LLC

- Accenture

- Oracle

Generative AI in Banking and Finance Market Segmentations

By Technology

- Natural Language Processing

- Deep Learning

- Reinforcement Learning

- Generative Adversarial Networks

- Computer Vision

- Predictive Analytics

By Application

- Fraud Detection

- Customer Service

- Risk Assessment

- Compliance

- Trading and Portfolio Management

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Why should you invest in this report?

This report presents a compelling investment opportunity for those interested in the global generative AI in banking and finance market. It serves as an extensive and informative guide, offering clear insights into this niche market. By delving into the report, you will gain a comprehensive understanding of the various major application areas for generative AI in banking and finance. Furthermore, it provides crucial information about the key regions worldwide that are expected to experience substantial growth within the forecast period of 2023-2030. Armed with this knowledge, you can strategically plan your market entry approaches.

Moreover, this report offers a deep analysis of the competitive landscape, equipping you with valuable insights into the level of competition prevalent in this highly competitive market. If you are already an established player, it will enable you to assess the strategies employed by your competitors, allowing you to stay ahead as market leaders. For newcomers entering this market, the extensive data provided in this report is invaluable, providing a solid foundation for informed decision-making.

Some of the key questions answered in this report:

- What is the size of the overall Generative AI in banking and finance market and its segments?

- What are the key segments and sub-segments in the market?

- What are the key drivers, restraints, opportunities and challenges of the Generative AI in banking and finance market and how they are expected to impact the market?

- What are the attractive investment opportunities within the Generative AI in banking and finance market?

- What is the Generative AI in banking and finance market size at the regional and country-level?

- Who are the key market players and their key competitors?

- What are the strategies for growth adopted by the key players in Generative AI in banking and finance market?

- What are the recent trends in Generative AI in banking and finance market? (M&A, partnerships, new product developments, expansions)?

- What are the challenges to the Generative AI in banking and finance market growth?

- What are the key market trends impacting the growth of Generative AI in banking and finance market?

Table of Content:

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Generative AI in Banking and Finance Market

5.1. COVID-19 Landscape: Generative AI in Banking and Finance Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Generative AI in Banking and Finance Market, By Technology

8.1. Generative AI in Banking and Finance Market, by Technology, 2023-2032

8.1.1. Natural Language Processing

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Deep Learning

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. GlucagoReinforcement Learning

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Generative Adversarial Networks

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Computer Vision

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Predictive Analytics

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Generative AI in Banking and Finance Market, By Application

9.1. Generative AI in Banking and Finance Market, by Application, 2023-2032

9.1.1. Fraud Detection

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Customer Service

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Risk Assessment

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Compliance

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Trading and Portfolio Management

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Generative AI in Banking and Finance Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Amazon Web Services Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Cisco Systems Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Microsoft Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. SAP SE

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. BigML Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Fair Isaac Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. IBM Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Google LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Accenture

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Oracle

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.pharma-geek.com